Unpaid Toll Scam Text Messages Taking Their Toll on the US

It feels as though everyone in the US has received an unpaid toll scam text this year, or even a robocall in some reported cases. The frequency of this scam has ramped up over the past year, with coverage about the toll scam appearing on news channels across the country. Unsurprisingly, TNS has received many reports of American’s receiving an unpaid toll scam text or robocall.

What is the Unpaid Toll Scam?

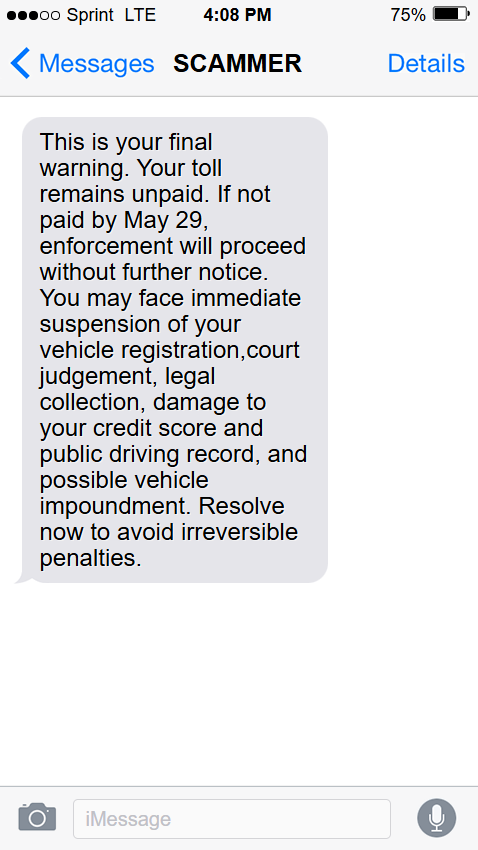

The scam itself is very simplistic; targets receive an unpaid toll scam text message attempting to collect money for a fraudulent unpaid toll. The text messages appear to be legitimate, with many including “.gov” URL links, and as we live in an increasingly paperless world, receiving a text about unpaid toll charges doesn’t seem too out of the ordinary.

The tone of the messaging or voice call can be very stressful to the consumer. There have been examples of pushing for payment or have your driver’s license revoked. The key is the desire to push the consumer to take an action.

While this scam can fail, when the toll scam text message refers to states or cities that the target victim hasn’t driven in for a long time or has never been to, there are many examples of targeting in the local area where the consumer lives begging the question if they actually did have an issue with a transponder.

Below is example of an unpaid toll scam text message, with the “.gov” link originally included removed:

How to Spot an Unpaid Toll Scam Text?

This scam has been very effective as the messages appear to be quite legitimate. However, with most scams, there are red flags that you can look out for to avoid falling for this scam:

- Most unpaid tolls start communication with you via a letter or invoice in the mail from the enterprise that owns the road

- Scammers will always create a sense of urgency, as seen in the unpaid toll scam text message above

- A link to pay, which looks suspiciously like an actual “.gov” or another agency website. However, these must always be double-checked and never clicked on

Currently, 36 US state and territories have toll booths or toll roads, and with electronic toll passes active in the majority of them, it is reasonable to believe that you may have missed paying a toll, especially if you live in or have recently travelled to the state of the alleged unpaid toll. However, it is important to remain vigilant to avoid falling victim to any unpaid toll scam text messages or calls that you receive.

How Do I Protect Myself from Unpaid Toll Scam Text Messages and Calls?

If you receive an unpaid toll text, TNS suggests the following:

- Never click on any of the links in the text, regardless of how legitimate they look

- If the text message you receive is from a state/city that you live in or have recently driven in, get in touch with the relevant agencies to check the legitimacy of the message

- Do not panic! It is easy to panic when you receive a message demanding immediate payment, especially when the consequences are so severe. Remember, this sense of urgency is a classic scam tactic

For those who receive a robocall or cold call regarding an unpaid toll, you can take the following actions:

- If you are not identified by name, ask the caller to confirm. If they do not have this information, hang up

- Once they have identified which agency they are allegedly calling from, hang up. Find the registered telephone number for that agency and call them yourself to confirm if you have any unpaid tolls or violations.

For both text and voice calls, the easiest path is to log in directly to your account with the toll authority. Accessing the account without selecting any link can allow you to validate directly to ensure that you do not have any balance or issue.

Other action you can take is to report the unpaid toll scam text messages and calls to the FTC and the FCC. By submitting a report, you can help these organizations to track down the scams, prevent bad actors from targeting others and help raise awareness of fraud prevention scams.

It is always best practice to never engage with unknown numbers and report phone numbers being used by scammers to your carrier. If you believe you are the victim of a scam, you can report it to your local police, state Attorney General’s office and the FTC.

Call-blocking apps, including those powered by TNS Call Guardian®, are also a great resource for reporting and blocking unwanted robocalls. Stay vigilant, share information about scams with others and be sure to check out our monthly Scam of the Month page updates.

Ready to Learn More?

Discover more about how TNS robocall protection services help your subscribers and expand your network.

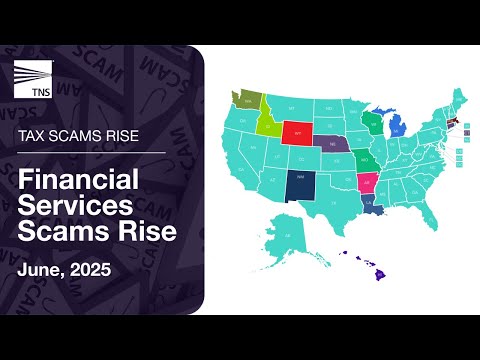

Robocall Heatmap

Discover which scams are most prominent across the US in our nationwide heatmap that plots the state-by-state picture of scams on a monthly basis throughout 2025.

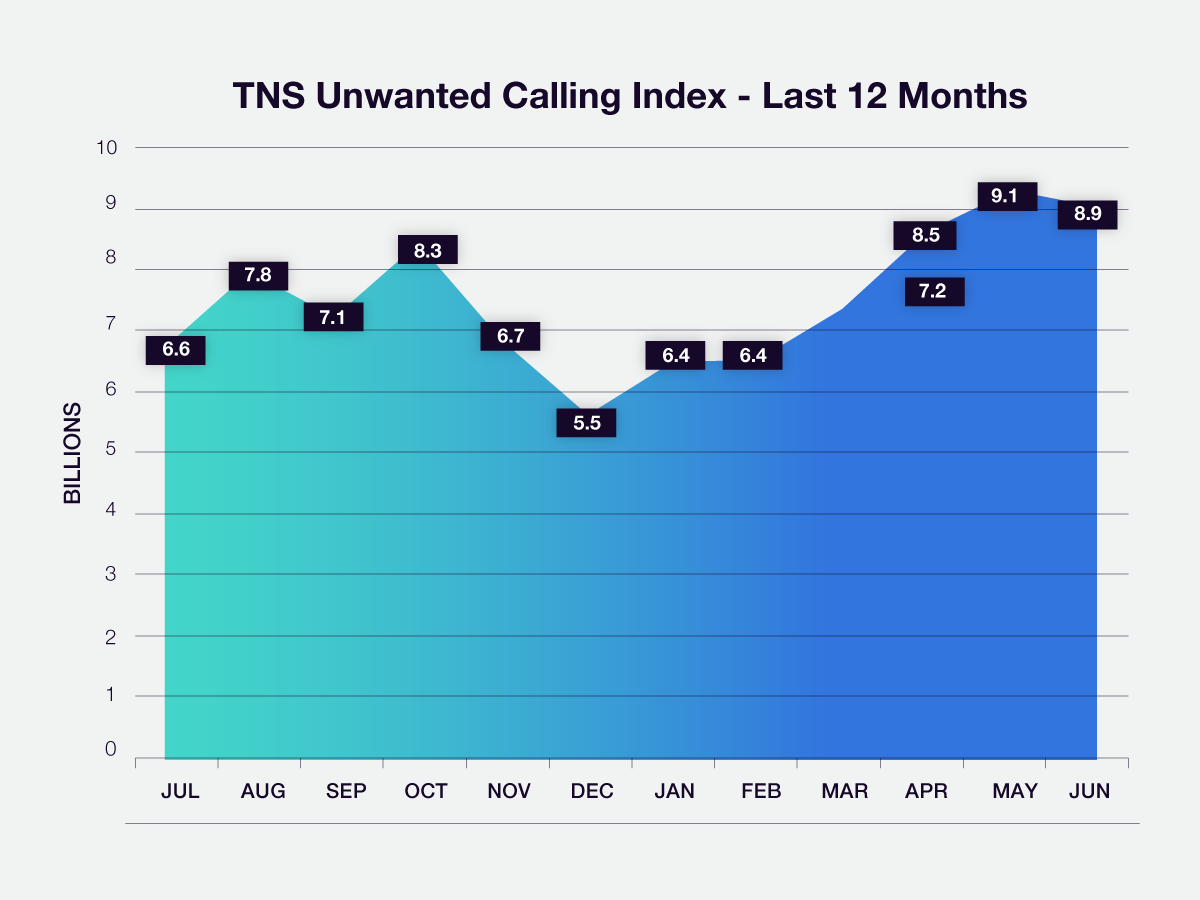

Unwanted Calls Nationwide Snapshot

TNS estimates that more than 88 billion unwanted calls were made in the last 12 months representing a 49% increase over the last 12 months versus the previous 12 months. Unwanted calls decreased 3% from May to June at 8.9B. This represents an 70% increase from June 2024 to June 2025.

Unwanted calls are comprised of nuisance calls and high-risk calls. The severity of harm of nuisance calls are moderate. The severity of harm for high-risk calls is deemed as a major invasion of privacy that can cause emotional distress.

TNS Heatmap of Originating Unwanted Calls

Top 10 Area Codes for Generating Unwanted Calls – June 2025 |

Top 10 Area Codes for Generating Unwanted Calls – May 2025 |

Top 10 Area Codes for Generating Unwanted Calls – June 2024 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

TNS Unwanted Call Indices

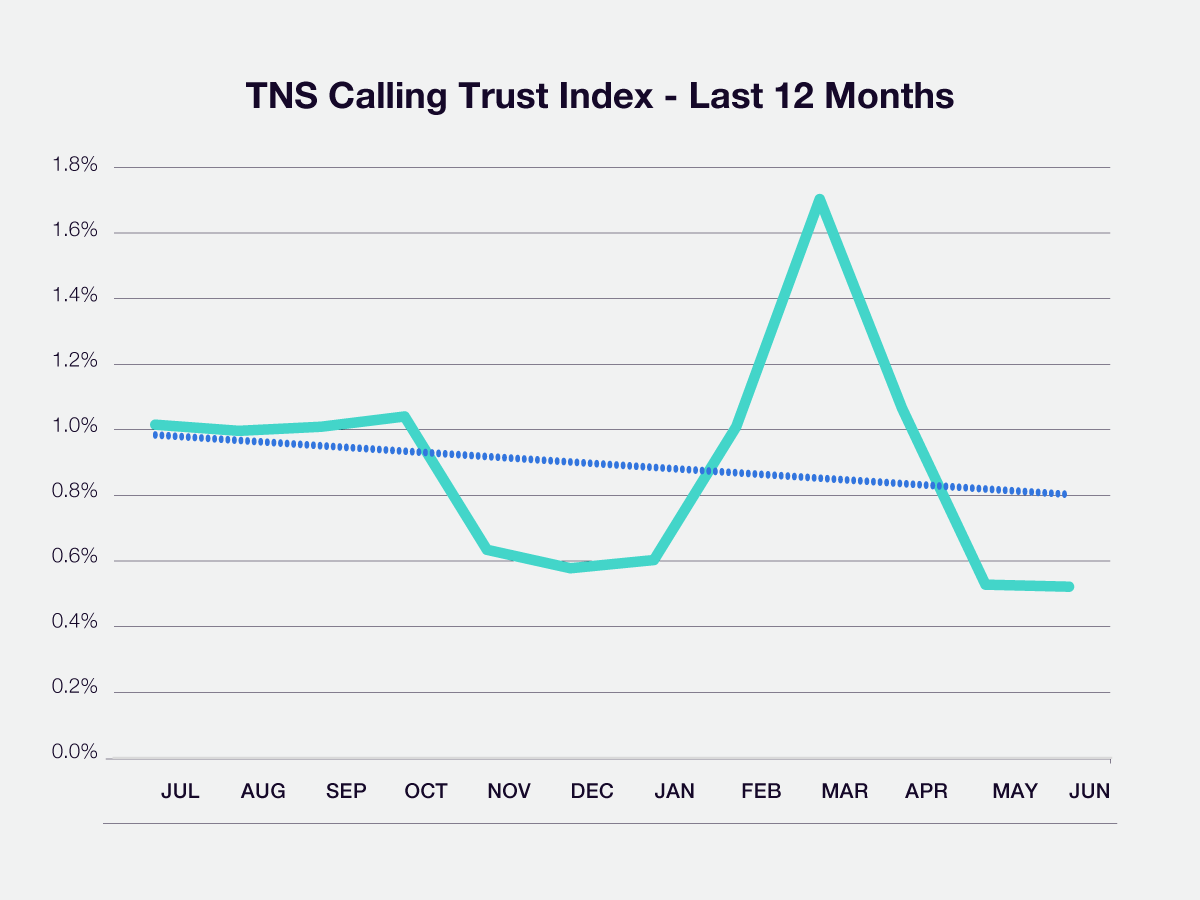

TNS Calling Trust Index – Last 12 Months |

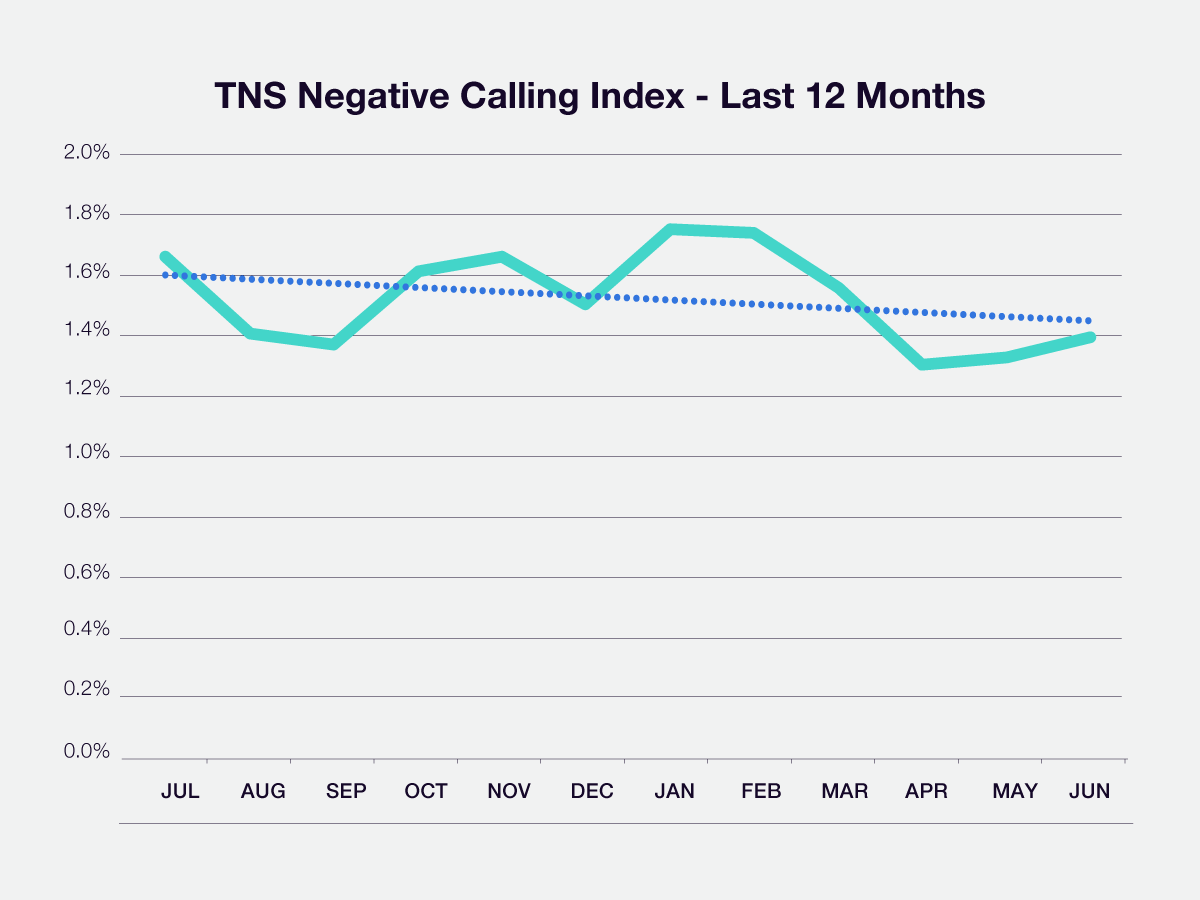

TNS Complaint Index – Last 12 Months |

TNS Calling Trust Index is a measure of the crowd-source feedback for the unwanted calls that TNS receives in relation to the total number of calls to a subscriber. The index gives an indication of the consumer trust in voice calling and pulls data from our robocall protection platform TNS Call Guardian®. |

Complaint Index is a measure of the FCC complaints for the Do-Not-Call List in relation to the total number of unwanted calls seen by TNS. The index gives an indication to how many consumers are reporting complaints to the FCC relative to the number of unwanted robocalls they receive. |

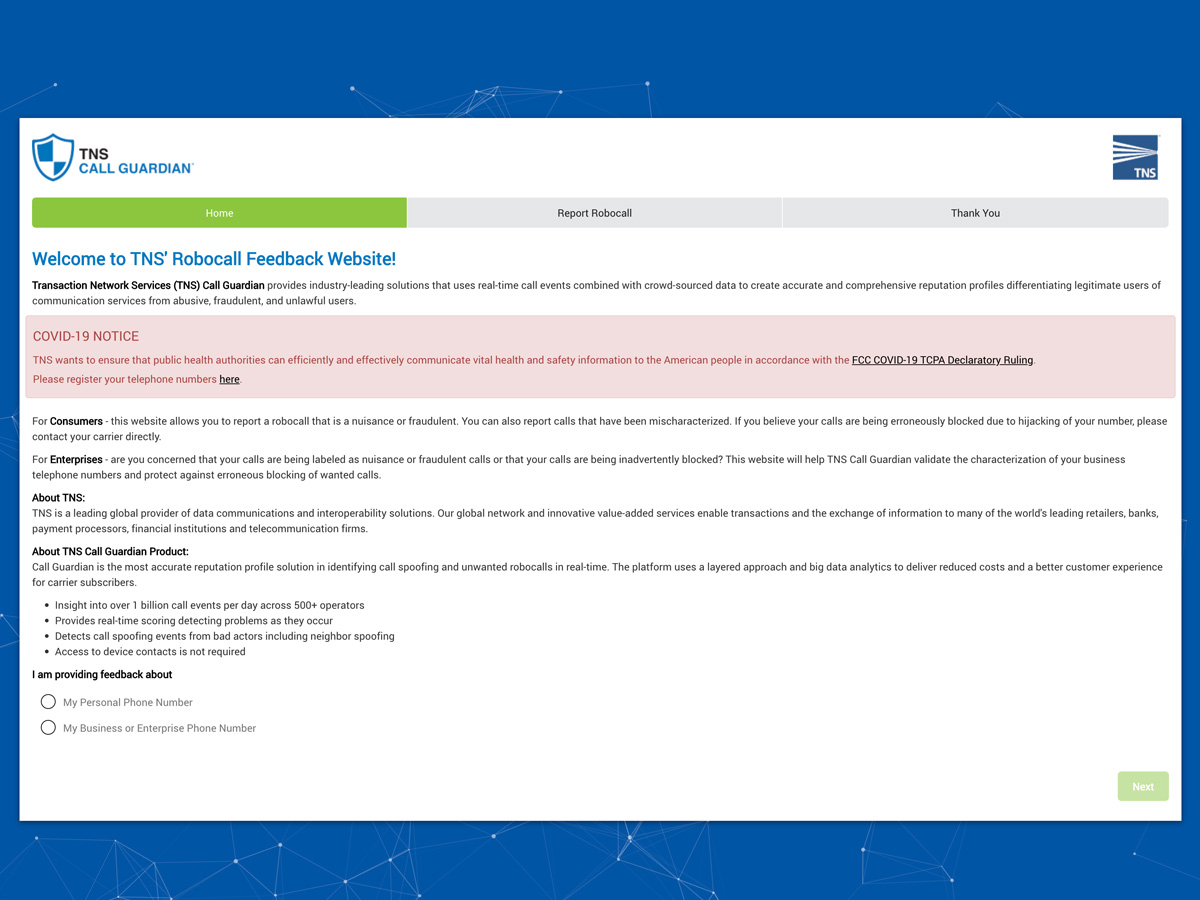

Take Action for Robocall Protection, go to: ReportARobocall.com

TNS Call Guardian uses real-time call events combined with crowd-sourced data to create accurate and comprehensive reputation profiles differentiating legitimate users from abusive, fraudulent and unlawful ones. Reporting robocall incidents adds important data making our solutions more robust.

Contact Us

Contact TNS to learn more about how our robocall protection services enhance your reputation and expand your business.

TNS Robocall Investigation Report Mailing List

Request to be added to the TNS Robocall Investigation Report mailing list today.