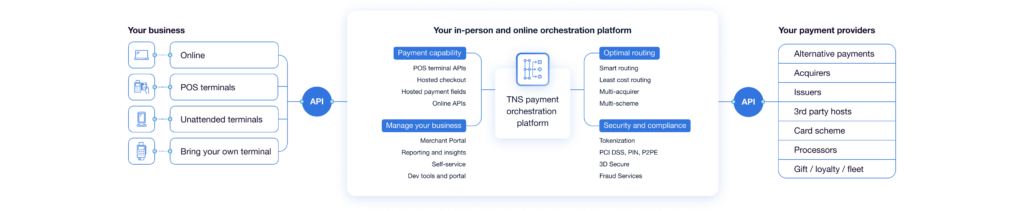

Your Cloud-Native Payment Orchestration Platform

Leading unattended merchants and enterprises trust TNS to process billions of transactions annually.

Simplify Your Payment Ecosystem

A single, cloud-native platform for payment orchestration. Build a flexible payment stack to power seamless omnichannel experiences using your preferred acquirers, alternative payment methods, integrations and service providers.

Omnichannel

Offer a seamless experience across any channel – including accepting alternative payment methods. Manage in-person, online and unattended payments in a single payment orchestration platform.

Optimal Routing

Minimize transaction costs, increase conversions and improve resilience against outages. Multi-acquirer, smart and least-cost routing direct your transaction the optimal way for your business.

Vendor-Agnostic

Bring your favorite vendors and hardware with you. Select the right acquirers, PSPs, payment methods, processors, banks, fraud services and terminals to suit your payments strategy with our payment orchestrator.

Single Integration

No need for you to build, add or maintain complex integrations. We take care of any traditional and alternative payments, terminal, channel, acquirer and fraud service for you – globally and in one centralized payment orchestration platform. Fast.

Developer Friendly

Give your developers more than just a spec sheet. Our developer portal has all the documentation and tools you need to make integration fast and easy.

Managed Security

Help reduce your regulatory burden and fraud risk with a secure, global solution. We make sure you adopt the latest compliance standards – including PCI DSS, PCI P2PE, PCI PIN and increase security with fraud and tokenization services in our payment orchestration platform

White Glove Service

Get help whenever you need it. Remote software updates, expert account managers and round-the-clock, 24/7 Global Service Support Centers mean your payments team can rest easy.

Real-Time Visibility

Manage your payments from a single dashboard. Process refunds, monitor payment terminal and online transactions, and get the real-time reporting and insights you need to make more informed decisions with our payment orchestration platform.

Flexible Payment Orchestration

Choose the custom features and services to build your unique payment stack

Cloud-Native Platform

Scale your business using a modern payment ecosystem with single API integration

Premium

Service

Your expert team offering support at every layer

Case Study

Scheidt & Bachmann

Providing 70% of the ticket vending machines across the UK is no small task. With 7.6 million transactions per year, Scheidt & Bachman uses TNS Payment Orchestration to keep up with customer demand.

Payment Terminals

Create convenient payment experiences for your customers with reliable and secure payment solutions. Designed for outdoor, unattended and in-person retail, TNS terminals are easy to integrate and deploy.

Online Payments

Take reservations and payments online or in-app – all in the same platform as your in-person system. Meet our modular cloud-native payment orchestration platform.

Complete Commerce

Why settle for a solution that only accepts and processes payments? Now you can consolidate your payments and network connectivity with one seamless solution.

Contact Us

Learn more about how our payment orchestration platform can support your business.