Amid rapidly changing consumer behavior, technology and regulatory demands, enterprises are challenged with navigating an increasingly complicated payment landscape.

Whether your enterprise has 50 retail outlets, hundreds of fuel and convenience locations or thousands of ATMs, the technological challenges of conducting consumer-facing payment interactions remain the same.

We cover 4 trends across the payments landscape and reveal how leading enterprises are future-proofing their businesses in the current environment.

4 Payments Trends Shaping the Retailer Landscape

Consumer-facing enterprises are pressured to manage the technological and organizational complexities of the modern environment, while delivering a user-friendly, reliable and secure customer experience.

Here are 4 trends that are top-of-mind for retailers and B2C businesses:

1. Customers’ expectations are rising.

Customers want what they want, when they want it – and in the way that’s easiest for them.

Customers have come to expect seamless, omni-channel experiences. They want the ability to try on a garment in-store, and then buy a different color online. This desire for instant gratification means their patience for friction in the buying journey is declining.

And this focus on speed in the payment process means that enterprises are under intense pressure to accept their customers’ preferred payment methods. The number of ways to pay has proliferated in recent years, including not just the range of traditional payment methods, but also digital wallets, QR codes and loyalty programs. In 2024, it’s predicted the world will hit 1 billion mobile payment users. Instant payments are also on the rise, playing a key role in changing the payments landscape.

To top it off, a customer’s preference may change from day to day. They want the flexibility to book an airport parking reservation at the terminal one week, and on an app the next – depending on what is most convenient for them, that day.

2. Technology continues to evolve at a breakneck pace.

From 5G to cloud-based solutions, advances in payment and connectivity technology force enterprises to continually adopt new solutions to keep pace with rising consumer demands – and the competition.

Enterprises must continually seek innovative solutions to elevate the way they do business, and then scale these technologies to power growth.

3. Complexity is causing ever larger problems.

And yet, it’s these new technologies and solutions that are simultaneously creating challenges. As new technologies emerge, fragmented payments and connectivity solutions layer to create complex business environments.

When an enterprise is managing old legacy systems and hardware, and then layers new technologies or applications on top, this complexity escalates. We’ve reached an inflection point where this complexity of solutions has a significant cost.

In the short term, complexity slows down business operations and in the long term, it hinders growth.

4. Risk is escalating.

Card fraud over the next decade will cost the industry a collective $408.50 billion in losses globally, according to an annual report from the industry research firm Nilson Report. By 2030, when total payment card volume is expected to hit a whopping $79.14 trillion, the industry will lose an estimated $49.32 billion to fraud.

On top of the challenge to secure customer data and remain compliant, businesses are feeling the increased pressure of protecting their reputation. Reputation damage from an incident in the modern environment is fast and cruel. Not only is a security failure is catastrophic to brand reputation – it is damaging to revenue and raises the potential of substantial remediation costs.

According to the Harvard Business Review, 70-80% of a company’s market value comes from intangible assets, including brand equity. And so protecting the brand’s reputation is a top priority.

How Enterprises Can Modernize Their Payments Infrastructure

To adjust to the quickly shifting environment, leading consumer-facing businesses are prioritizing tech stack upgrades. Here are some considerations that are top-of-mind:

Gain insights that deliver faster, more integrated experiences. To meet rising customer expectations, enterprises need systems that accept any payment the customer wants to use, and infrastructure that connects disparate experiences all in real time.

Action item: Focus on the omni-channel experience, re-orienting your tech stack to harness real-time information and insights.

Use the cloud to power your digital transformation. In a world where millisecond delays cost money, companies with modernized payments infrastructure will gain the strategic advantage. Meeting the demands of the current landscape requires the scalability and agility of cloud-based solutions.

Action item: Choose a tech layer that integrates with legacy systems, but also enables cloud-powered growth.

Commit to tackling complexity, which is both costly and problematic. Standardization reduces time, cost and enhances capabilities. For enterprises tied into legacy solutions, shifting away requires a comprehensive plan. Taking the time to build a comprehensive cloud-based solution will pay long-term dividends.

Action item: Replace siloed, individual solutions and separate providers with a unified solution.

Remove risk with resilient system and network solutions to keep your customers’ payment information secure. Payments are business-critical, complex and time-sensitive, and so avoiding failed payments and security breaches is imperative to protect your enterprise’s revenue and reputation.

Action item: Protect customer data with solutions that meet the highest security standards, across the entire payment process.

Introducing Complete Commerce

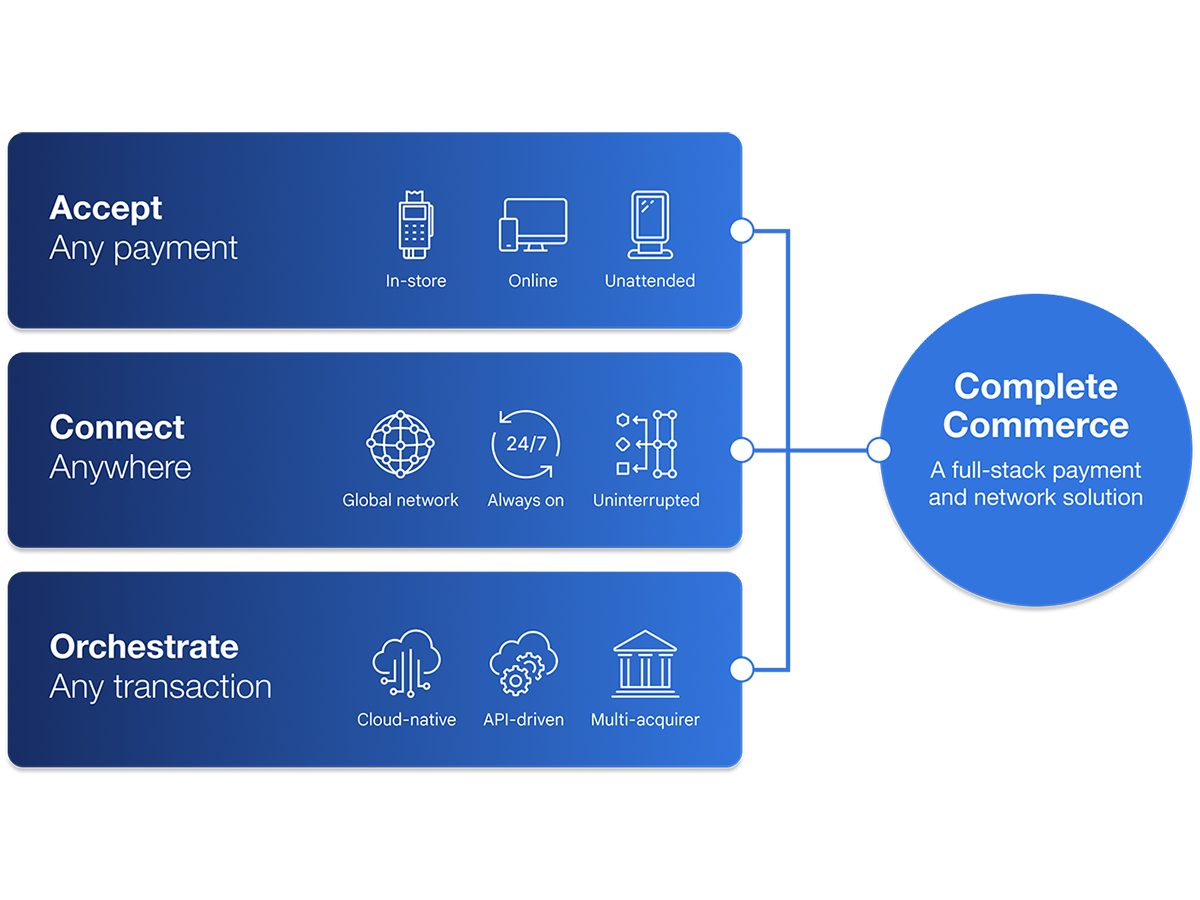

TNS has launched Complete Commerce to tackle these myriad challenges – and help enterprises modernize their payments tech infrastructure. Complete Commerce removes the complexity of payments and connectivity with a full-stack, modern and secure payment and network solution.

Complete Commerce helps you:

- Unify business insights

Make better, timely business decisions that meet rising customer demands with the help of insights and real-time reporting. Our online portal gives you total visibility across all payments, transactions and network activity – so you can get alerts, track device status and create custom reports. - Reduce complexity

Simplify your payments and connectivity ecosystem by replacing multiple vendors with a single trusted, telco-agnostic partner. Complete Commerce enables you to accept any transaction at terminals and online, connect POS terminals with retail stores, and orchestrate payment transactions via our cloud-native platform. It’s a fully managed, modular solution that streamlines operations and adapts to your business – while removing your administrative burden. - Enhance security

TNS protects the entire payment process, wherever it starts and wherever you need it routed. Complete Commerce helps your business secure sensitive data and maintain compliance with the latest security standards across payments and network connectivity, including: PCI DSS, PCI P2PE, PCI PIN certifications and use of PCI PTS v6.x devices.

TNS takes care of every aspect of your payments and connectivity – so you can focus on your business. Our fully managed service includes 24/7/365 proactive monitoring, an always-on help desk with local experts, zero-touch updates and seamless installation.

David Hore is Director, Payments Architecture and Orchestrate Portfolio Lead at TNS with responsibility for its Accept and Orchestrate payments portfolios for the Payments Market division.

Ready to Learn More?

Learn more about TNS’ Complete Commerce.