Connect Any Device, Any Location, Any Network

TNS is the preferred choice by ATM operators, retailers, processors and financial institutions to be their managed network service provider in more than 50 countries.

Managed Network Services

Keep Networks Running Smoothly so You’re Always Open for Business

One Stop Shop for Networking Needs

Payment infrastructure is becoming increasingly complex, and TNS’ end-to-end managed connectivity services ensure the pieces fit together seamlessly – so your payment systems and network environment simply work.

TNS delivers secure, flexible and cost-effective managed network that connects data centers, retail stores and branches, payment devices, and mission-critical devices such as video security, IP phones and alarms.

TNS removes the need for customers to manage multiple vendors, we are your one stop shop to manage all your IT and networking needs, so you can focus on driving your business forward, not on managing your network.

Maximum Uptime

A reliable managed network service provider.

- Multi-carrier SIM card automatically selects best-performing networks

- Redundancy at every stage keeps your business running

- Zero-touch provisioning minimizes downtime

- 24/7/365 support for quick problem resolution

Reduced Complexity

A single, fully managed solution.

- Manages connectivity services, routers and software licenses

- Flexibly connects to payment partners of your choice

- Minimizes administration and compliance burden

- One contract, one supplier, one monthly fee

Highly Secure

Securely processes your transactions to thousands of global end points.

- Level 1 PCI DSS certified service provider

- Protect payments from interruptions, malicious actors and other threats

- Smart routing ensures optimized delivery of payments data

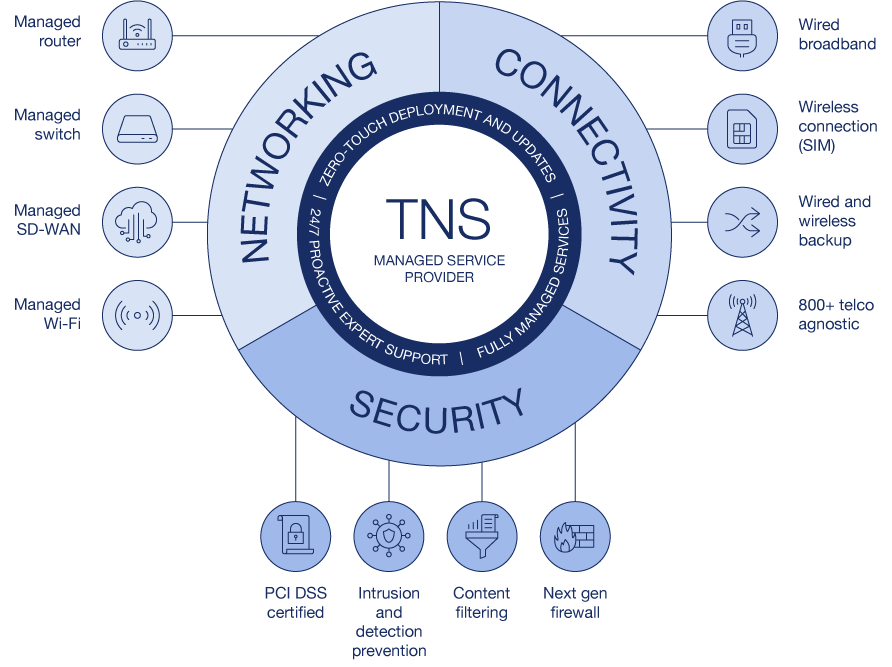

The Connect Portfolio

As a managed network service provider, we deliver, maintain and support all network components and environments – including connectivity services, infrastructure, routers, equipment and software licenses while providing 24/7/365 technical support. We keep your networks running smoothly, no matter what equipment your business uses.

Managed Network Connectivity

TNS provide broadband and wireless connectivity with multi-carrier SIM cards for full redundancy

Managed Router

Supports a wide selection depending on the needs of ports and connectivity of each site, including single-router and high-availability deployments

Core Network

Providing direct access to payments ecosystem partners, merchant acquirers and processors

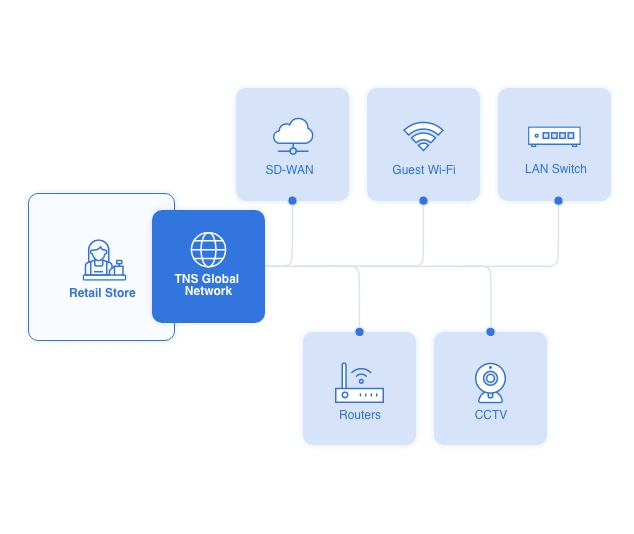

Solutions for Complex IT Network Environments

SD-WAN, Wi-Fi, LAN switch, cloud connectivity, internet breakout

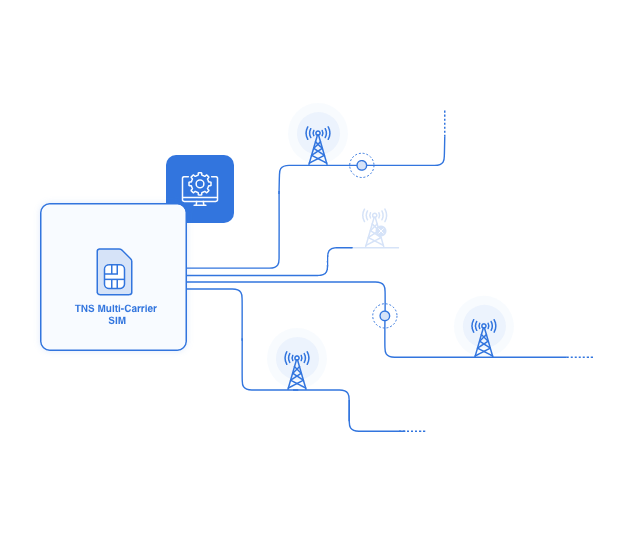

Multi-Carrier SIM

POS Terminal SIM Connectivity

Provide Resilient Connectivity

Our smart multi-carrier SIM offers managed network connectivity for payment terminals and IoT devices by providing multiple telco options through a single SIM.

TNSLink for Retail

Retail Site Connectivity

Fully Managed Network

Securely connect payment devices, in-store networks, data centers, third-party or public cloud environments, regardless of where they are located, with a broad array of LAN, WAN and SD-WAN managed network services.

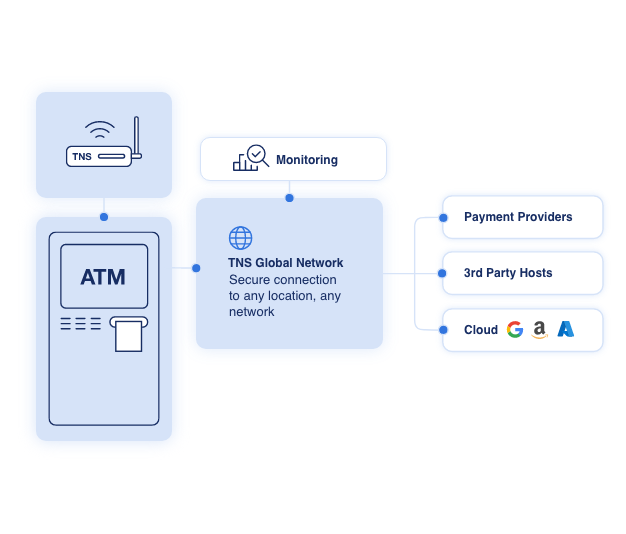

TNSLink for Unattended

ATM and Payment Device Connectivity

Managed Network Infrastructure

Securely connect payment devices, in-store networks, data centers, third-party or public cloud environments, regardless of where they are located, with a broad array of LAN, WAN and SD-WAN managed network services.

Ready to Learn More?

Contact TNS to learn more about how we can support your business as a managed network service provider.

Connect and Route Traffic

Managed SD-WAN Improves Flexibility and Performance

Grow and Streamline Your Business

Software-defined networking, known as, SD-WAN, connects and routes traffic dynamically, adapting to changed conditions to ensure your business performance and network environment runs smoothly – all without intervention by an IT specialist.

As a managed network service provider, we offer a SD-WAN solution that is ideal for multi-site enterprises looking to scale up their business while removing the complexity and cost of their IT network operations. With SD-WAN, you can streamline your operations and simplify your network and security.

Expand Your Global Footprint

TNSConnect Simplifies Integrations Through a Single Connection

Managed Service Provider

TNSConnect is a managed network solution providing unlimited network capacity and global redundancy between your enterprise location, data centre or cloud partners to thousands of existing TNS partners globally.

TNS Connect avoids the complexity of having to establish individual connections to various endpoints. You can easily expand your footprint to the main data centres in the world and securely connect to exchange transactions with third-party service providers, while maintaining end-to-end visibility and control.

Case Study

Supporting Z Energy’s Emergency Response with Starlink Satellite Connectivity

Secure SD-WAN Services

See how TNS and Z worked together to bring service stations, truck stops, and air stops with TNS Secure SD-WAN services back online using Starlink satellite terminals.

“We could not have got those essential services restored without the standout partnership we receive from TNS, who we know are equally committed to delivering during extraordinary circumstances.”

– Vance Anderson, Head of Digital Delivery at Z Energy.

Contact Us

Learn more about how TNS can support your business as a managed network service provider.