- Prev

- 1

- of

- 14

Learn More about TNS Payments Capabilities

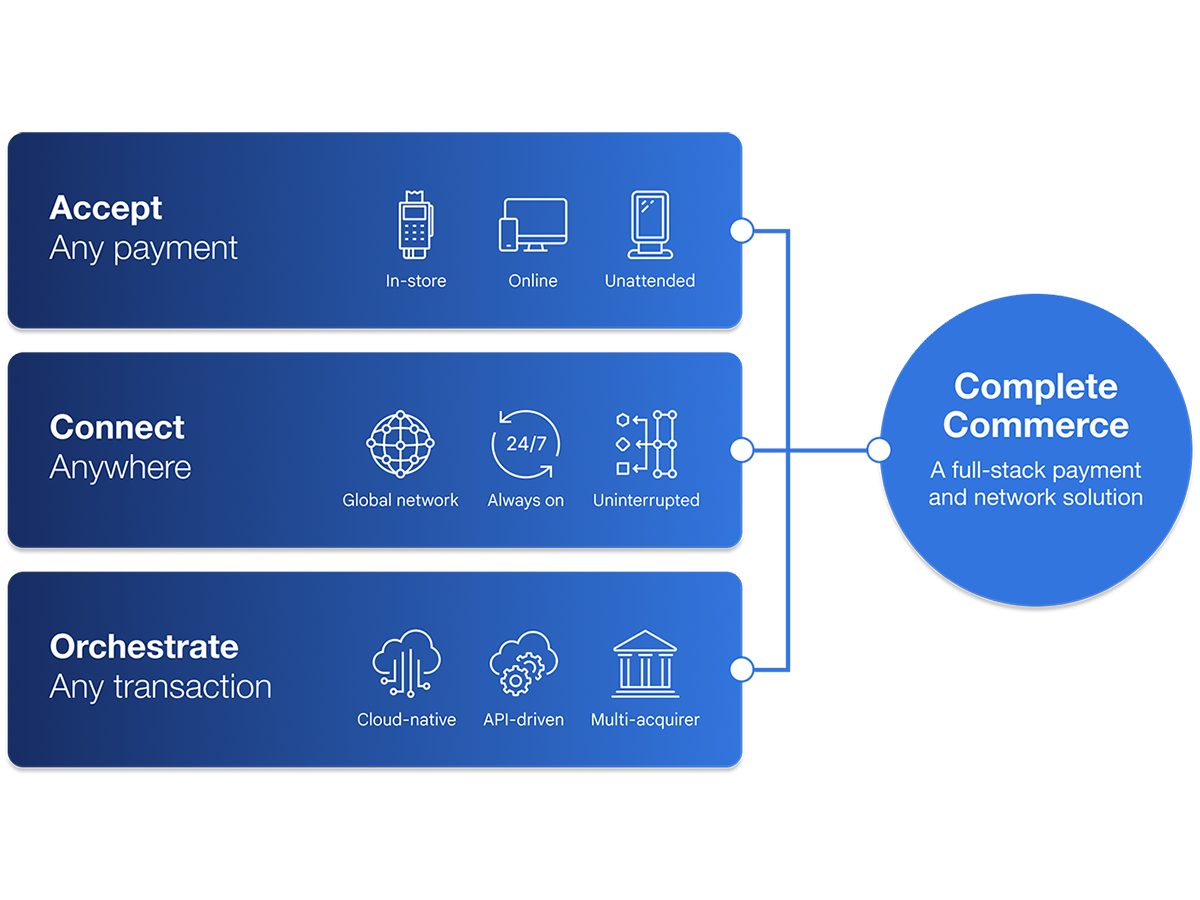

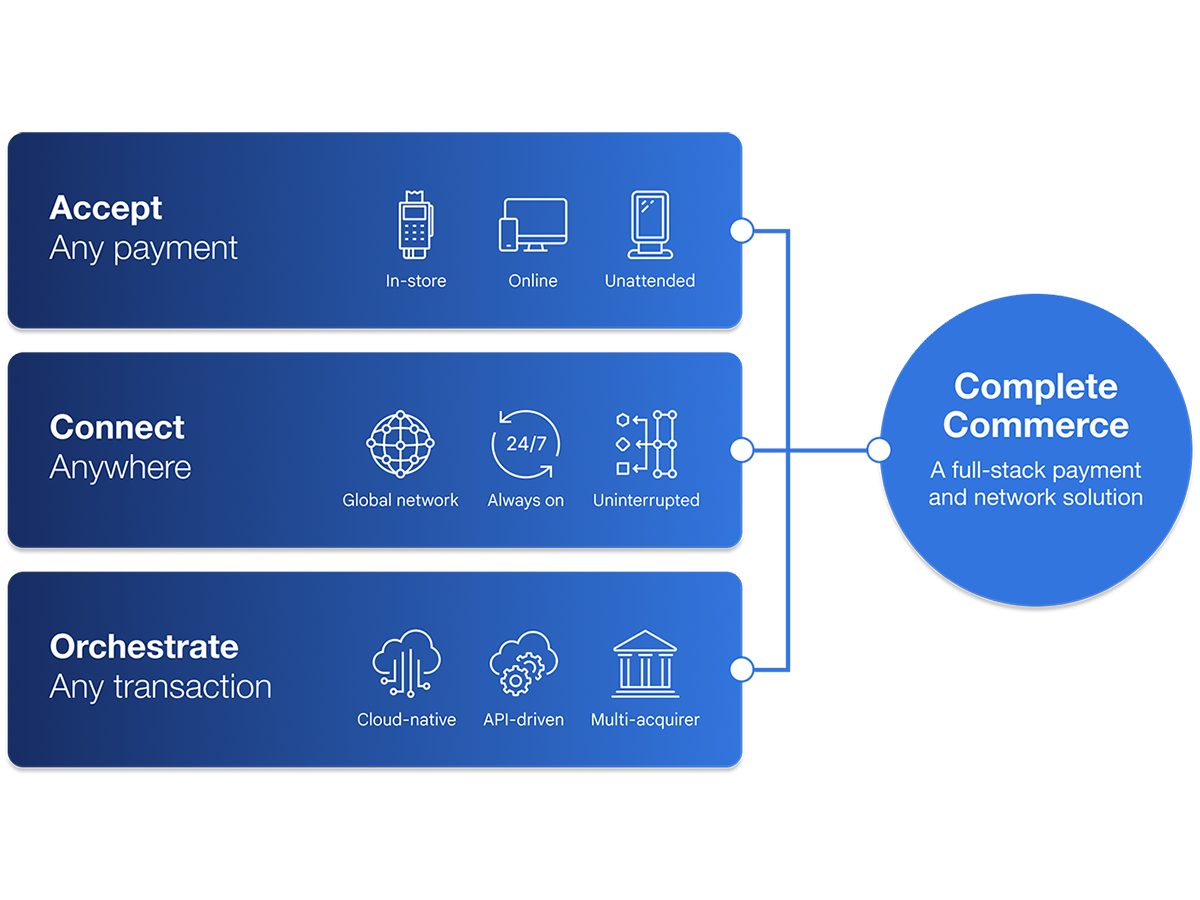

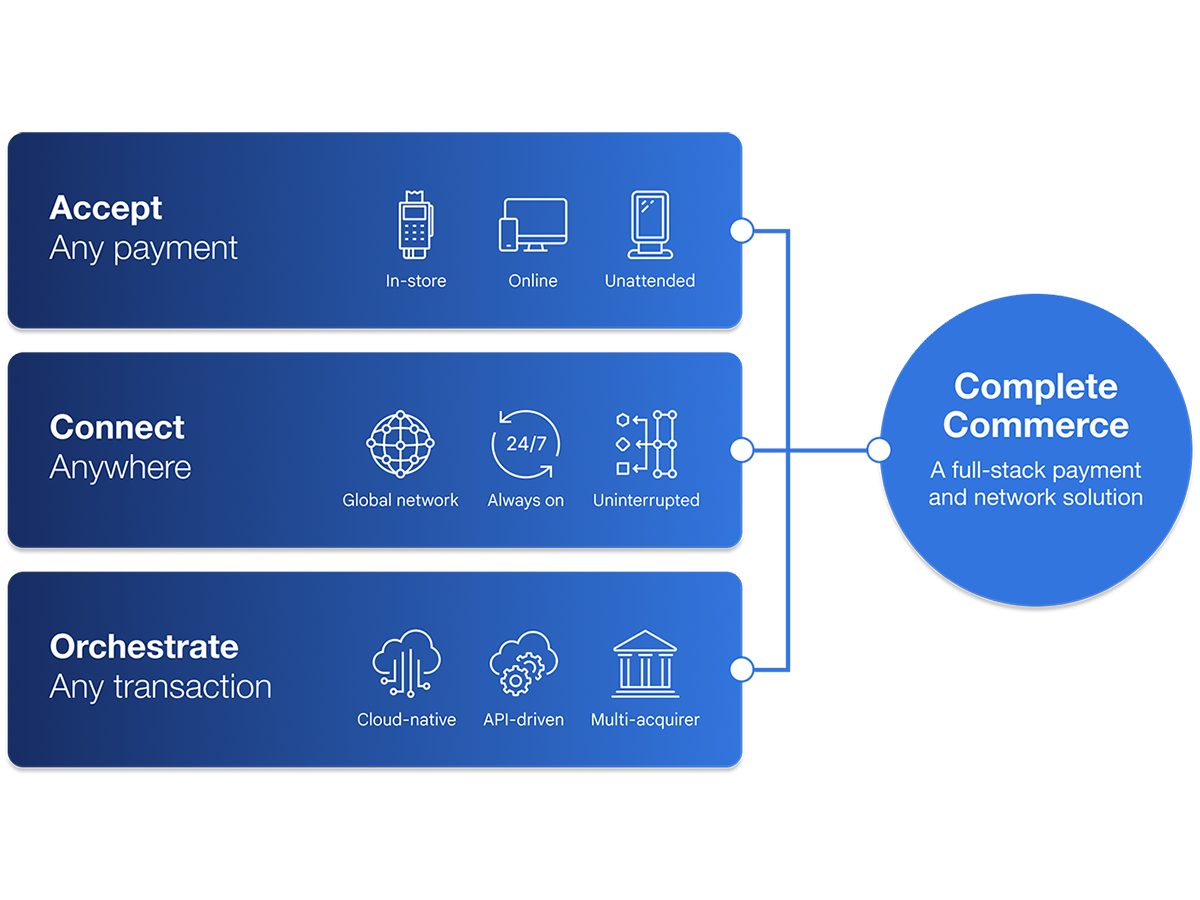

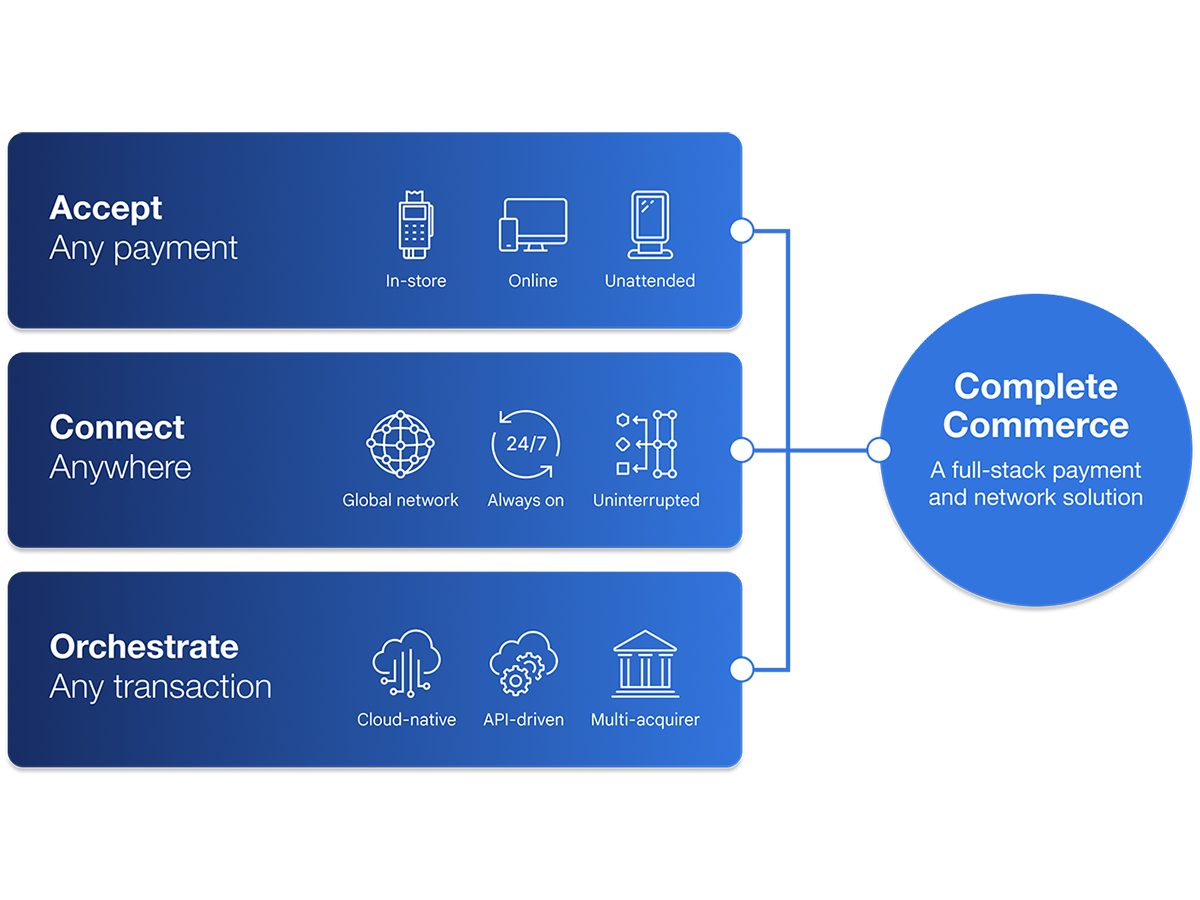

TNS’ payments solutions are constantly adapting to the needs of businesses like yours. Explore our evolving payment acceptance, connectivity and orchestration capabilities.

TNS Payments Resources

As payment infrastructure becomes more complex, IaaS solutions from TNS enable you to concentrate on growing and maintaining your business. Find white papers, case studies and more resources on how TNS empowers businesses to accept, connect and securely process transactions across the globe.

TNS’ payments solutions are constantly adapting to the needs of businesses like yours. Explore our evolving payment acceptance, connectivity and orchestration capabilities.