Like spaghetti and meatballs, or eggs and bacon, sometimes two things just make more sense together than each one does on its own. Think of a business owner looking at revenues and profit separately, for example. Each number has meaning on its own, sure — but without the context that both numbers create together, a business owner is missing something big.

Let’s consider another must-have combination for businesses: network communications solutions and payments security services. The first provides the overall connectivity backbone for a business’s electronic payments needs, while the second adds a layer of data security through point-to-point encryption (P2PE) and tokenization. These seem to be separate technologies that businesses would need to use two different vendors for — but, in fact, that isn’t always the case.

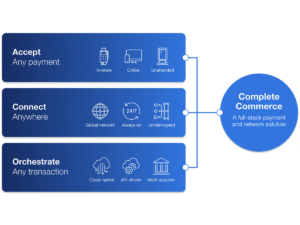

With TNS, businesses can choose to bundle their connectivity and their payments security under a single provider. TNS has connectivity (payments and otherwise) covered with our TNSLink, TNSConnect, and TNS Secure SD-WAN products, while our TNS PayProtect suite keeps all the transaction data on the network locked down and secure.

If you’re not sure if bundling these two technologies makes sense for your business, check out five benefits you can gain by doing so:

Data security: Establishing data security comprises two key things: defend and devalue. By pairing network communications with payments security services, you get both at once: defense via private connections, and devaluation via P2PE and tokenization. Plus, with TNS, you are working with a Level 1 PCI DSS certified service provider. By partnering with TNS for managed network services, not only is a business’s payments data kept secure, but complying with PCI DSS becomes a simpler task, because the network is out of the merchant’s PCI scope .

Simplicity: The more vendors you have, the more vendors — and contracts — you have to manage, and having a single-source provider for multiple services makes vendor management that much simpler. What’s more, using a managed-services provider (MSP) like TNS for both network connectivity and payments security also means a business doesn’t have to do the heavy lifting when it comes to designing and integrating network and data security with its communications infrastructure. Instead, for the infrastructure that TNS manages and controls, we monitor network traffic and data while also handling necessary firmware updates and PCI DSS compliance. And who couldn’t use more simplicity in their business?

Cost-savings opportunities: Bundling two services together under the same provider creates economies of scale that don’t exist when using different vendors for separate but related services. Vendors often are able to offer some flexibility in pricing when businesses select more than one service within their portfolio, opening the possibilities of initial cost savings and/or lower total cost of ownership.

High-touch service under one roof: TNS offers help desk support 24 hours a day, seven days a week, 365 days a year, for all of the services it provides. Businesses that bundle services under TNS not only have access to experienced support whenever they need it, but they also only need to call one vendor with questions. It might not sound like much, but think about all the phone calls you make in a single month. If you can eliminate a few because you only need to call one provider instead of two or three, that saves hours that could be spent much more productively.

A richer overall offering: Stacking services from a single vendor naturally creates a better overall product than Frankensteining together services from different vendors or trying to build them yourself. Not every solution provider offers network solutions and payments security services under one roof, so it’s not always possible to “bundle” these, per se. For example, a business can get a connectivity solution from a telco company, but there’s no guarantee the telco also can provide the transaction security layer (many don’t). On the other hand, a business can contract with a provider that specializes in P2PE and tokenization, but oftentimes, those vendors don’t also offer connectivity.

With TNS, any business that needs reliable connectivity as well as secure, compliant payments transactions can bundle these critical services for a better overall experience — not to mention data security, simplicity, potential cost savings, and high-touch service.

Dan Lyman is Head of Global Products for TNS’ Payments Market business. He leads a global team of product specialists and is responsible for driving product innovation across TNS’ extensive portfolio of payments solutions.