If you’re feeling overwhelmed by your company’s payment ecosystem, you’re not alone. From juggling multiple payment methods to keeping up with ever-changing regulations, today’s retailers have a lot on their plate.

Did you know that 31% of payments in the US are now made through alternative payment methods? Keeping up with the explosion of digital wallets, QR codes and buy-now-pay-later options is just one of the many hurdles facing businesses today.

The surge in digital transactions, increased consumer demand for convenience and speed, and growing concerns over cyber security all place immense pressure on the underlying payment infrastructure. Addressing these challenges head-on is essential for merchants to deliver seamless experiences and stay ahead of the competition.

In this post, we’ll delve into the five key challenges of navigating the modern payment landscape. And in our upcoming posts, we’ll show you how a strategic approach can turn these obstacles into opportunities.

“The financial landscape is evolving at a rapid-fire pace, with retailers facing an unprecedented number of challenges in their payment processing systems.”

– John Tait, Global Managing Director Payments Market, TNS Payments division

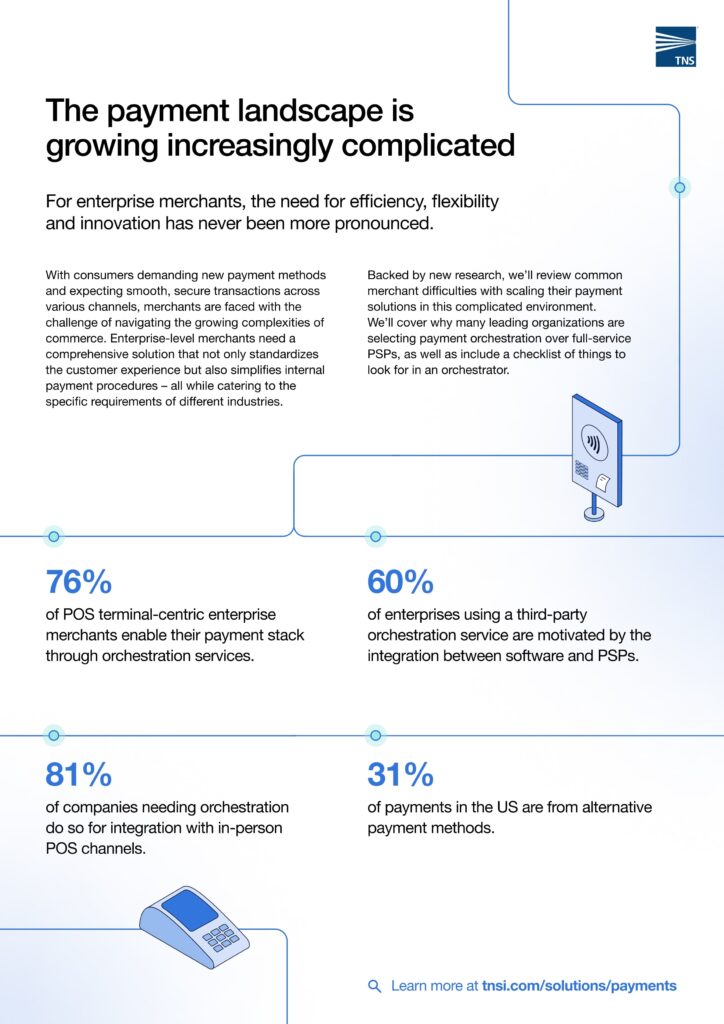

The Payment Landscape is Growing Increasingly Complicated

With consumers demanding new payment methods and expecting smooth, secure transactions across various channels, merchants are faced with the challenge of navigating the growing complexities of commerce.

Enterprise-level merchants need a comprehensive solution that not only standardizes the customer experience but also simplifies internal payment procedures – all while catering to the specific requirements of different industries.

- 76% of POS terminal-centric enterprise merchants enable their payment stack through orchestration services

- 60% of enterprises using a third-party orchestration service are motivated by the integration between software and PSPs

- 81% of companies needing orchestration do so for integration with in-person POS channels

- 31% of payments in the US are from alternative payment methods

Five Challenges Merchants are Facing with Payment Processing

Amid rapidly changing consumer behavior, technology and regulatory demands, enterprises are challenged with navigating an increasingly complicated payment landscape.

Here are five trends today’s retailers are facing:

1. Customers’ expectations are rising

Customers demand omnichannel experiences with easy payment options across in-person and online channels. Today’s shopper wants to try on a garment in-store and then buy a different color online. And merchants that don’t offer a frictionless experience will find themselves lagging behind competitors who do.

At the same time, the number of ways to pay are proliferating – leaving enterprises under intense pressure to accept their customers’ preferred payment methods. Customers want to pay not just with traditional payments, but also with ‘alternative payment methods’ (APMs) including digital wallets, QR codes, buy now pay later and loyalty programs.

2. The payment space is increasingly fragmented

Technology continues to evolve at a breakneck pace. From 5G to cloud-based solutions, advances in payment and connectivity technology force enterprises to continually adopt new solutions to keep pace with rising consumer demands – and the competition.

In addition to the standard components to accept and process payments (including the range of payment options described above), fit-for-purpose POS terminals (such as fuel pumps or self-service laundry machines) require payment switching to build an ecosystem.

Many enterprises are frustrated by the lack of true one-stop-shop convenience. Global commerce has made it more difficult to work with a single payments provider that provides best-in-class service across payment types and commerce environments.

This complexity causes problems. Especially if an enterprise is also managing legacy systems and hardware, and then layers new technologies or applications on top.

Enterprises must continually seek innovative solutions to elevate the way they do business, and then scale these technologies to power growth. All while trying to keep the ecosystem simple enough to manage.

3. Risk is escalating

Retailers have always tried to protect their customers’ payment data. But with payment card fraud losses projected to hit $49 billion by 2030, security at the point of payment has come to the fore.

On top of the challenge to secure customer data and remain compliant, businesses are feeling the increased pressure of protecting their reputation.

Reputation damage from an incident in the modern environment is fast and cruel. Not only is a security failure catastrophic to brand reputation – it can be damaging to revenue and raises the potential of substantial remediation costs.

According to the Harvard Business Review, 70-80% of a company’s market value comes from intangible assets, including brand equity. And so protecting the brand’s reputation is a top priority.

Furthermore, unplanned outages and downtime can negatively impact the customer experience and also inflict financial losses on merchants. Given these factors and the constant threat of cyber attacks, merchants cannot tolerate any network vulnerabilities.

4. Merchants want to grow globally

As technology and digital commerce enhancements break down regional barriers, merchants are globalizing. This increases their need for extensive localized service coverage, critical to driving conversion and customer acquisition.

And while the trend towards APMs is worldwide, the individual methods vary widely across countries – PayPal/Venmo in the US, LayBuy in the UK and Afterpay in Australia. This adds even further payment complications to global companies operating in multiple regions.

5. Regulatory compliance is increasing

Regulatory requirements impose strict rules on data protection, security, and payment processing. Payment providers across regions must comply with existing and upcoming regulatory measures (e.g., PCI DSS, PSD3 and applicable data privacy laws), which only becomes more complex the more markets an enterprise operates in.

Where are Payment Ecosystems Heading?

To tackle the complexity of today’s changing landscape, merchants are often left to navigate a patchwork of vendors, each offering different services and tools. And there’s no guarantee that they fit together.

This is particularly the case for merchants with unattended terminals, who must find bespoke solutions that fit with their existing equipment and ways of operating – and who still aim to scale and offer omnichannel experiences.

It’s complication on top of complication. For enterprise merchants, the need for efficiency, flexibility and innovation has never been more pronounced.

Download Report

This is just a snapshot of the increasing complexity in the payment landscape. That’s why we’ve worked with Flagship Advisory partners to create a report that helps you overcome common payment roadblocks.