Retailers have always tried to protect their customers’ payment data. But with payment card fraud losses projected to hit $49 billion by 2030, security at the point of payment has come to the fore.

In addition to elevated fraud risk, retailers are also contending with increasing regulatory requirements and the pressure of reputational damage.

In this blog post, we’ll cover key features you should look for to secure your entire payment process. And we’ll suggest steps to help ensure your payments are protected.

Protecting payments is more important than ever

Keeping payments secure is complicated in the current landscape. Three emerging trends are challenging today’s merchants.

Increasing regulatory and compliance requirements

Regulatory requirements impose strict rules on data protection, security, and payment processing. With an increasing number of payment and data protection regulations coming into effect, merchants need to rely on their providers to comply with existing and upcoming regulatory measures (e.g., PCI DSS, PSD2 and GDPR). This only becomes more complex the more markets an enterprise operates in.

Heightened threat of reputational damage

On top of the challenge to secure customer data and remain compliant, businesses are feeling the increased pressure of protecting their reputation. Reputation damage from an incident in the modern environment can be fast and cruel. Not only could a security failure be catastrophic to brand reputation – it can also be damaging to revenue and raises the potential of substantial remediation costs.

Escalating fraud risk

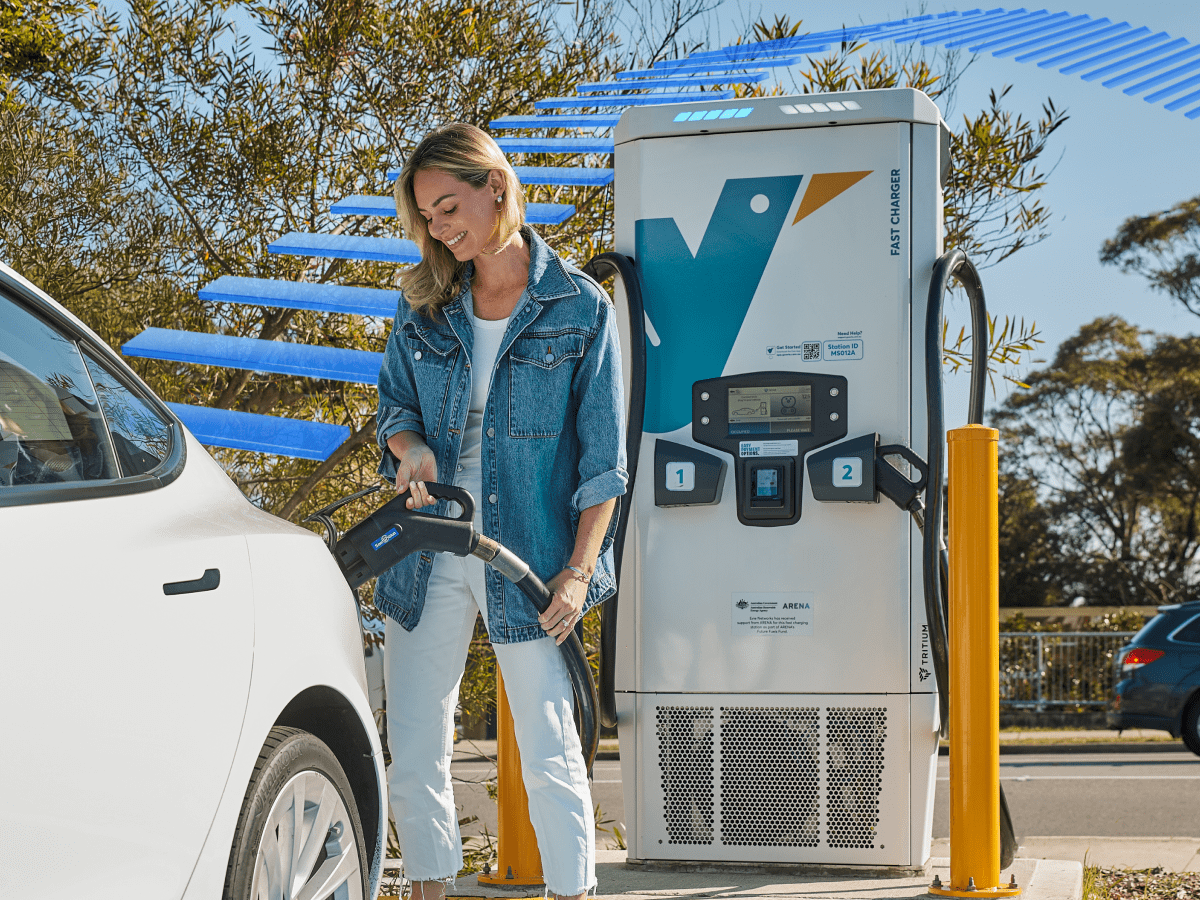

With everything from automated bots to targeted attacks, the variety of fraud methods is on the rise – and so is the overall economic impact. Merchants are under increasing pressure to secure their customers’ payment information at every step of the payment journey. This means online, in-store and everywhere in between.

What to look for in a secure payment ecosystem

Your payments solution must keep your customer and company data safe. When you’re looking at a payment processor, here are some features you should consider.

PCI DSS-compliance or certification

PCI DSS is a set of security guidelines for anyone that is processing, transmitting or storing credit card data. The highest standard is a Level 1 PCI-DSS-certified provider.

PCI DSS certification is obtained via a comprehensive process performing both internal reviews and external assessments to achieve and maintain compliance with the strict requirements of PCI DSS that is updated from time to time to take into account the key industry threats.

TNS has been Level 1 PCI DSS certified for 18+ years, since PCI DSS was introduced. Both our payments processing and network infrastructure are PCI DSS certified.

PCI DSS compliance shows that a company follows best practices.

Point-to-point encryption (P2PE)

P2PE converts credit card information into an encrypted code at the point of payment, helping to prevent fraud. P2PE is a standard set by the PCI Security Standards Council (SSC). A P2PE validated solution will ensure the highest level of protection and will help secure your transactions and reduce your PCI DSS compliance burden.

Tokenization

Many retailers store a customer’s credit card information in their online payment system, making future checkouts faster and easier. Tokenization keeps this payment information safe by replacing a customer’s actual credit card number with a token. This means that the merchant never has access to the original card number.

Blacklist BINs and cards

When fraudulent activity is suspected, blocklisting services can block either individual cards or bank identification numbers (BIN).

3D Secure

Add an additional layer of authentication to keep online transactions secure, making you PSD2 regulation-compliant.

reCAPTCHA

Advanced detection that prevents malicious software from attacking your website and mobile apps.

Protect your payments with payment orchestration

While the payment landscape is growing increasingly complex, so are the number of security and fraud services available.

The plethora of options can often leave merchants with more complications than before. Consumers expect smooth, secure transactions across various channels, leaving merchants to navigate a patchwork of single-purpose tools that don’t easily integrate with each other. And any friction at the point of purchase can decrease conversion rates, something every merchant wants to avoid.

In this post, we’ve only scratched the surface – because security is only one factor to keep in mind. That’s why we’ve worked with Flagship Advisory partners to create a report that helps you navigate common payment challenges.

We’ll cover:

- Five common challenges unattended merchants are facing with payments

- Comparing three types of payment ecosystems to tackle the complexity of payments

- A side-by-side comparison of ecosystems by use case

- An in-depth investigation of payment solutions according to business size and complexity

- New research about the payment orchestration landscape

PLUS this report includes a checklist of considerations you can use to analyze any prospective payment orchestrator

It’s time to get your payments in sync. Our newest report will show you how.

Umer Ayub is Chief Risk Officer at TNS with responsibility for the company’s compliance and operational risk functions across all three businesses portfolios.