- Prev

- 1

- of

- 11

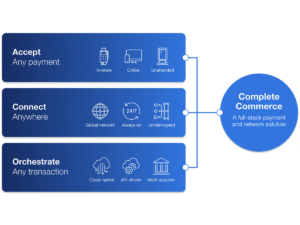

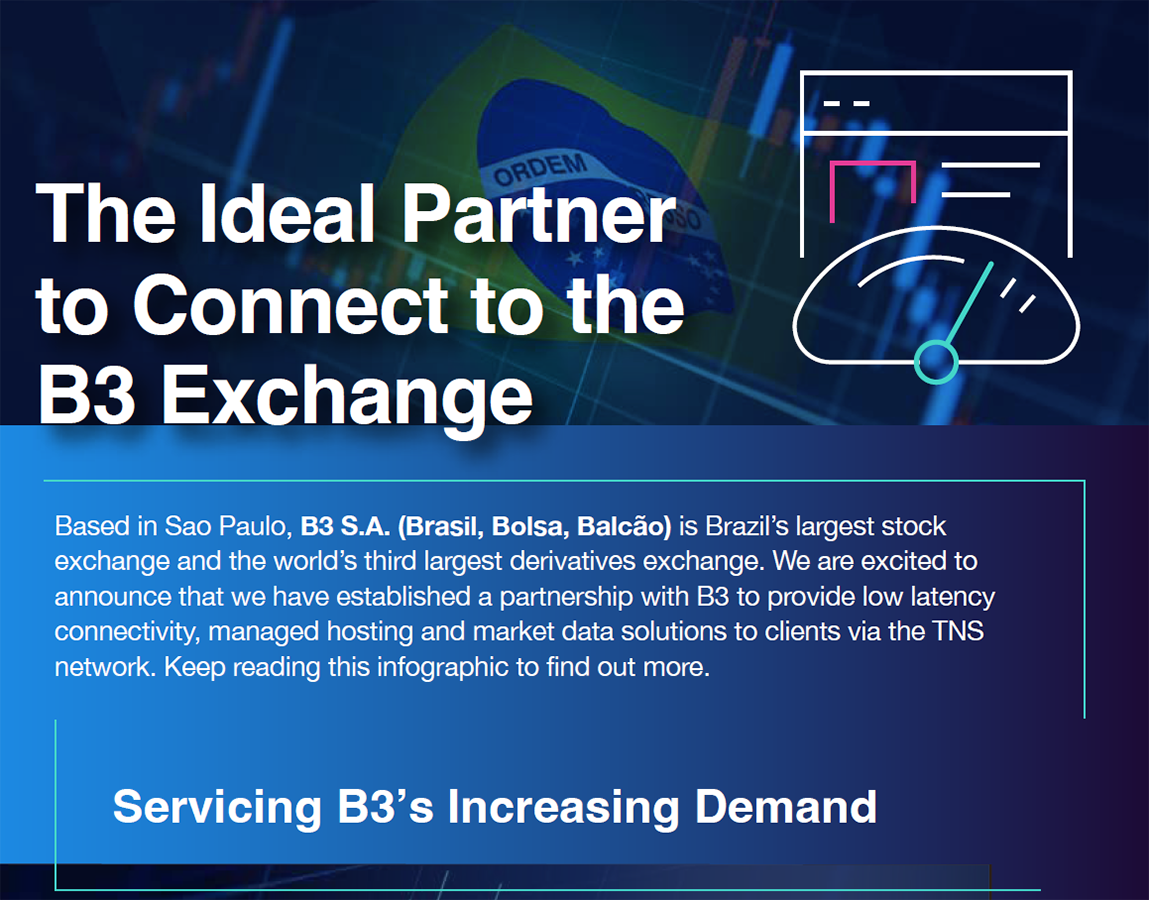

Learn More about TNS Financial Markets Solutions

For 30 years, TNS has connected organizations to global financial markets and data. Our ultra-low latency trading solutions are on the cutting edge of connectivity. Learn more about our evolving and flexible financial markets solutions.