B3 S.A. (Brasil, Bolsa, Balcão) is Brazil’s largest stock exchange and the world’s third largest derivatives exchange. Yet it is a vastly underserved market for traders outside of South America, despite nearly 500 companies listed on the exchange and an increasing demand, especially for US, European and other traders who are seeking optimized connections with the exchange.

Why? It is likely due to the challenge created by a do-it-yourself (DIY) approach when acquiring and installing hardware in Brazil, which is a process that often spans several months. To put it simply, cost and time. TNS is available to help financial market participants overcome these issues and put Brazil firmly back into their global trading strategies. Keep reading this blog to find out three of the ways TNS is increasing global trading opportunities in South America.

1. Managed Hosting and Colocation Services Overcome Complexities

The process of acquiring data center space and installing hardware in Brazil is bypassed with TNS. We recently established colocation services with B3, delivering seamless connectivity via the TNS ultra low latency trading network. We can significantly help reduce the burdens, complexities and costs attributed to ‘going direct’.

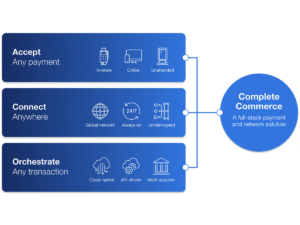

Trading execution, speed and infrastructure reliability are the critical components needed for expanding global trading access. Through our partnership with B3, we can provide low latency connectivity, managed hosting and market data solutions via the TNS network.

2. Local Knowledge and Expertise In-Country

We have a trusted and proven commitment to South America, having launched market data access for traders at B3 in 2021. TNS has had an office in Brazil since 2019 and recently opened a new Latin American headquarters in João Pessoa, Paraíba with more than 100 employees in country.

We’re empowering global traders with unparalleled efficiency and access while delivering our full suite of services immediately, with pre-established data center equipment on-site that is fully operational.

3. New Cloud Technologies Available in Brazil

Earlier this year, we launched TNS Dedicated Server, marking the first phase in the deployment of our Cloud platform for financial markets. The solution helps standardize performance, improve time to market and optimize costs while providing low-latency network access.

We recently extended the build out of our Cloud platform with the introduction of TNS Cloud – Server Management. Bringing the benefit of cloud to low-latency trading infrastructures and co-location environments, the solution delivers a full-suite of trading infrastructure and support to buy- and sell-side institutions and their vendors. Previously, as a trading organization, you would often outsource cloud data center services and still had to manage your own server resources. But now, we are breaking new ground with Server Management and our established colocation capabilities, by providing both infrastructure and end-to-end server management.

The combination of our decades of financial exchange experience, dedicated 24x7x365 support and local presence in Brazil makes TNS the ideal partner to connect clients to the B3 exchange.

For more information, visit tnsi.com/solutions/financial/.

Jeff Mezger is Vice President of Product Management at TNS with responsibility for its managed services for the financial industry. He oversees product development and strategy for market data, online and data center services.