TNS has launched its popular Managed Hosting and Colocation offering in Madrid, which is set to benefit financial market participants looking to access Spain’s principal stock exchange, Bolsas y Mercados Españoles (BME).

This is TNS’ first deployment in Spain and joins Frankfurt, Germany and Bergamo, Italy as the organization’s third Managed Hosting and Colocation venue in mainland Europe. It is the seventh site in Europe for TNS with Basildon, LD4, Interxion and LSE in the UK. The announcement underpins TNS’ commitment to investing in its European infrastructure.

“Working with TNS will enable capital markets participants to improve the way they incorporate BME into their trading infrastructure,” said Jeff Mezger, TNS’ Vice President of Product Management. “For those who have held back from accessing BME because they did not want to colocate themselves, we can now do it for them. With BME colocation joining TNS’ low latency network in Europe, TNS can provide market data to virtually any of the major equities exchange data centers in Europe.”

Trade execution speed is extremely important for profit and loss, and competitive advantage comes from having the best communication links to hardware in the best location. The combination of colocation with BME and ultra-low latency Layer 1 connectivity inside the data center enables firms to access execution speeds that are up to 10 times faster than traditional Layer 3 architectures. Layer 1 technology remains the most advanced solution, eradicating the need for multiple switches by using a simple, single hop architecture to deliver connectivity in as little as 5 to 85 nanoseconds.

The TNS offering provides lower overall costs compared to a DIY approach, due to TNS’ mutualized exchange connections and status as a registered data vendor with BME. This allows trading firms to focus on their core business instead of diverting the attention of internal resources to maintain an extensive infrastructure.

BME manages all Spanish stock markets, operating Bolsa de Madrid, Bolsa de Barcelona, Bolsa de Bilbao, Bolsa de Valencia, and the derivates exchange MEFF. Bolsa de Madrid is the listing exchange for multinational companies such as ArcelorMittal, America Movil, Banco Santander and Telefonica. These companies and others make up the IBEX 35, the leading stock index in Spain. MEFF offers stock index futures including IBEX 35 futures, energy derivatives and FX derivatives.

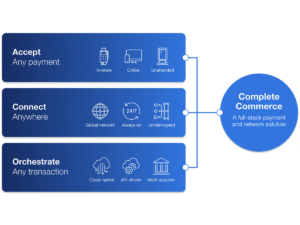

TNS brings together over 2,800 financial community endpoints, supported by a global, 125-strong point-of-presence footprint. Specifically designed and engineered to address the needs of financial market participants worldwide, TNS offers a range of connectivity, colocation, cloud, market data and VPN solutions within its Infrastructure-as-a-Service (IaaS) portfolio. Its solutions are monitored 24x7x365 by TNS’ Network Operations Centers in the US, UK, Australia and Malaysia.