While unattended payments have been around for a while, their recent explosion in popularity has changed commerce. Leading enterprises are taking advantage of self-service options to reduce costs and scale their businesses. And customers likely enjoy benefits of unattended payments, too. 80% of in-store customers prefer self-service checkout over a cashier (PYMNTS, 2021)

While unattended payments can benefit both retailers and customers, the quickly evolving payment landscape may leave merchants scrambling to adapt. In this post, we’ll cover the top trends affecting unattended retailers so you may be prepared to tackle them head-on. This will help enable you to take full advantage of the conveniences a consolidated unattended payment ecosystem can offer.

What Are Unattended Payments?

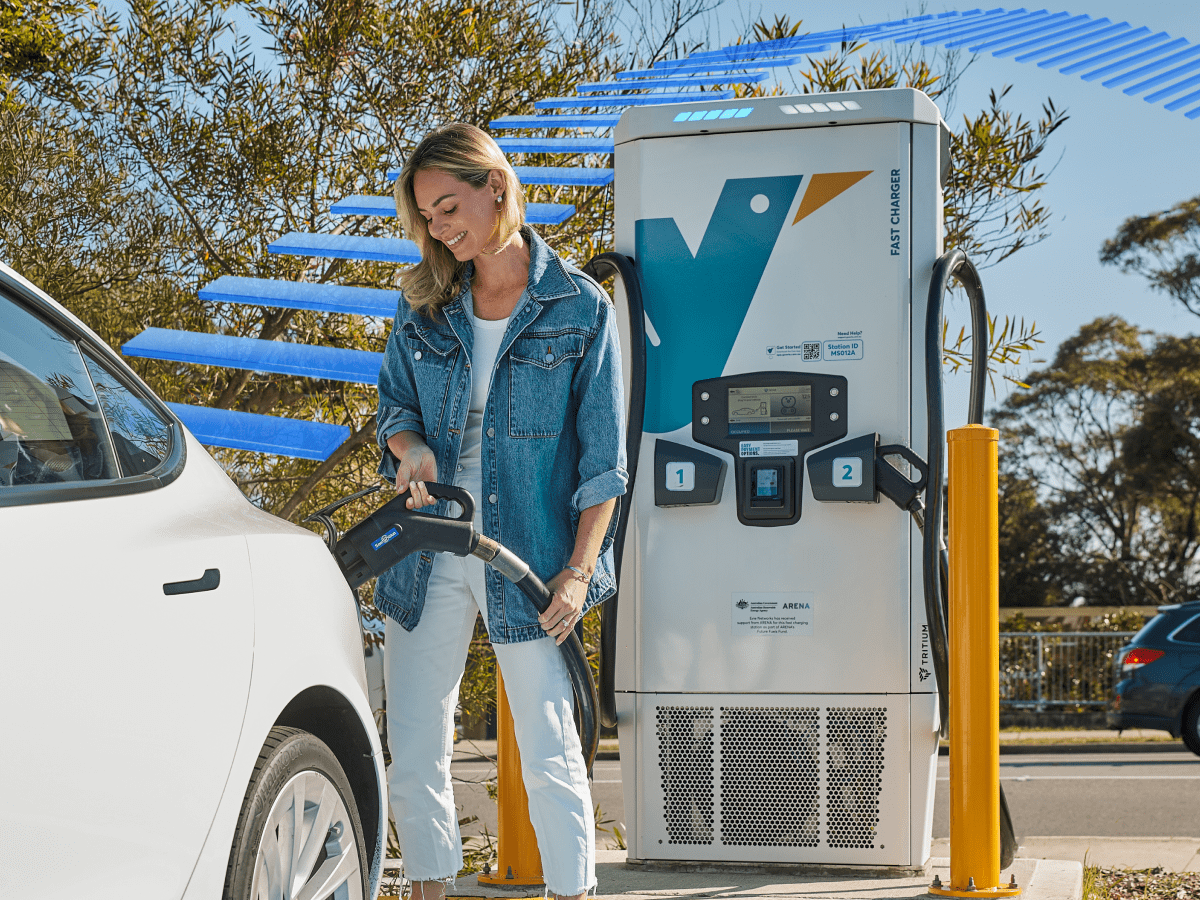

Unattended or self-service payments are any type of Point of Sale (POS) solution without a cashier. They appear in a variety of terminals, equipment integrations and kiosks across industries. And they’re exploding in popularity. From cashless laundromats to vending machines that sell freshly squeezed juice, consumers increasingly want self-service options. Unattended payments can take place in a fully unattended location (such as a laundromat with no staff on-site) or in a partially staffed location.

Unattended Payments Are Growing Business

Across industries, companies are using self-service options to make a significant impact in their business. An unattended solution helps enterprises offer better customer experiences, use staff more efficiently and scale their business more easily.

Here are a few common use cases:

- Parking: Unattended parking stations, contactless parking meter payments, in-app parking payments

- Vending: Tap-and-go vending machines in shopping centers, airports etc.

- Laundry: Cashless laundry machines

- Fast Food: Self-service kiosks, in-app ordering

- Retail And Grocery: Self-service checkout, in-app ordering

- Fuel & Convenience: Simplify fuel and convenience with payment orchestration, Pay-at-pump, in-app payments, EV charging

Top Challenges In Unattended Payments

For unattended merchants with a diverse hardware footprint, careful consideration of POS technology and payment processing vendors is nothing new.

Here are seven payment challenges today’s unattended retailers are facing:

- Customers demand omnichannel experiences

Customers demand streamlined omnichannel experiences with easy payment options across in-person and online channels. Today’s shopper wants the option to browse items online and try on the item in store. And merchants that don’t offer a frictionless experience may find themselves lagging behind competitors who do. - Alternative payment methods are proliferating

Customers do not want to pay just with traditional card schemes, but also with alternative payment methods (APMs) including digital wallets, QR codes, buy now pay later and loyalty programs. This puts enterprises under intense pressure to accept their customers’ preferred payment methods to remain competitive. This trend towards APMs is worldwide, but the individual methods vary widely across countries – PayPal/Venmo in the US, LayBuy in the UK and Afterpay in Australia. This adds even further payment complications to global companies operating in multiple regions. - The payment space is increasingly fragmented

Enterprises are already adopting new technology to accept and process the growing range of payment options. For fit-for-purpose POS terminals (such as fuel pumps or self-service laundry machines), this additionally requires payment switching to build an ecosystem. It’s no wonder that so many enterprises are frustrated by the lack of true one-stop-shop convenience. Because complexity can cause problems. Especially if an enterprise is also managing legacy systems and hardware, and then layers new technologies or applications on top. - Regulatory compliance is increasing

An increasing number of payment regulations have come into effect this year, with no signs of slowing down. Payment providers across regions must comply with existing and upcoming regulatory measures (e.g., PCI DSS, PSD3 and GDPR), which only becomes more complex the more markets an enterprise operates in. - Reputation protection is top of mind

A security failure can be catastrophic to a brand’s reputation, putting more pressure on the need to secure customer data and remain compliant with regulations. With 70-80% of a company’s market value coming from intangible assets like brand equity and goodwill, protecting their payment infrastructure has become a top priority. - Outages severely impact businesses financially

Unplanned outages and downtime negatively impact the customer experience and can also inflict financial losses on merchants. Given the potential impact and the increasing threat of cyber attacks, merchants cannot tolerate any network vulnerabilities.

- Shrinking regional barriers power global commerce

As technology and digital commerce enhancements break down regional barriers, merchants are globalizing. This increases their need for extensive localized service coverage, which is critical to driving conversion and customer acquisition.

Tackle The Complexity Of Payments

In this post, we’ve revealed seven major challenges – but that’s only scratching the surface of the increasing complexity in the payment landscape. That’s why we’ve worked with Flagship Advisory partners to create a report that helps you overcome common payment roadblocks.

While customers expect smooth, secure transactions across various channels, the plethora of options for unattended retailers can often leave these merchants with more complications than before.

We’ll cover:

- Five common challenges unattended merchants are facing with payments

- Comparing three types of payment ecosystems to tackle the complexity of payments

- A side-by-side comparison of some ecosystems by use case

- An in-depth investigation of some payment solutions according to business size and complexity

- New research about the payment orchestration landscape

PLUS this report includes a checklist of considerations you can use to analyze prospective payment solutions.

Keep your unattended payments in sync. Our newest report will show you how.

David Hore is Director, Payments Architecture and Orchestrate Portfolio Lead at TNS with responsibility for its Accept and Orchestrate payments portfolios for the Payments Market division.