TNS has significantly expanded its low latency global backbone across the Asia Pacific region and now offers access to most Asian exchanges including major financial players such as Hong Kong Exchanges and Clearing (HKEX), Singapore Exchange (SGX) and Japan Exchange Group (JPX).

This expansion has been engineered to make use of the lowest latency commercially available network links in the region. It employs subsea cable systems and protected network links to ensure the highest network uptime. Most importantly, this network has been designed with sufficient capacity to ensure delivery of streaming market data globally, with the ability to deliver APAC sourced market data to the US, and US sourced market data to APAC.

TNS’ already strong Asia Pacific presence now offers extensive coverage across 11 countries and 23 exchanges in Asia and continues its leadership position of delivering high performance managed solutions for the trading industry.

“The Asian financial markets include many of the world’s leading, as well as rapidly emerging, stock exchanges. Extending TNS’ presence and connectivity in Asia gives us the ability to offer traders access to these financial centers and exchanges simply, quickly and with a lower total cost of ownership,” said Tom Lazenga, TNS’ Vice President of Global Sales.

“It is a very exciting time in Asia as the financial markets are experiencing a period of significant global growth leading to opportunities for investors which we are helping to facilitate with our rapid expansion in region.” Lazenga added.

Connecting to multiple markets, however, is a complex initiative so it is advantageous to work with a managed service provider like TNS that has over 30 years’ experience, has local support in the region and can deploy the lowest latency solutions available. TNS’ Layer 1 solution delivers connectivity in as little as 5 to 85 nanoseconds, making it up to 10 times faster than traditional layer 3 architectures.

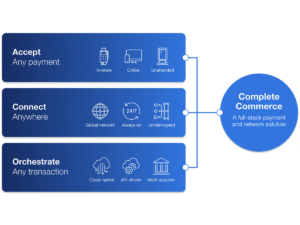

For traders looking to invest in Asia, TNS offers a full suite of low-latency services including order routing, market data access and Managed Hosting. As a managed service provider, TNS removes the complexity of researching, procuring, installing and managing trading infrastructure.

TNS brings together over 2,800 financial community endpoints, supported by a global, 125-strong point-of-presence footprint. Specifically designed and engineered to address the needs of financial market participants worldwide, TNS offers a range of connectivity, colocation, cloud, market data and VPN solutions within its infrastructure as a service (IaaS) portfolio. Its solutions are monitored 24x7x365 by TNS’ Network Operations Centers in the US, UK and Australia. For further information visit tnsfinancial.com.