As if the past year hasn’t been challenging enough for operations leaders in the payments industry, end-of-life deadlines for 2G or 3G networks in many parts of the world are swiftly approaching. This will impact millions of 2G and 3G devices, including point-of-sale (POS) terminals, which contain modems that cannot connect to all generations of network, particularly when it comes to older devices. If an organization’s terminal estate includes POS terminals that do not support 4G, they will need to be swapped out with solutions that do.

That’s because, as carriers begin sunsetting their 2G or 3G networks, they will “refarm” those network spectrums, allocating more to the generations they plan to keep. They may also stop investing in 2G/3G networks (e.g., by not repairing tower receivers), especially the closer they get to their end-of-life dates.

This will increasingly degrade network performance as transition ramps up and more core coverage and capacity moves over. Eventually, quality of service will degrade to the minimum contractual commitment, and 2G or 3G payments terminals dependent on guaranteed connectivity may no longer function as intended.

Service providers that operate in regions affected by a carrier’s network generation shutdown need a transition plan for their customers. In fact, even those in regions where carriers are not shutting down 2G or 3G need to consider what they might do when or if that day comes.

To avoid some of the potential challenges of reterminalization, operations leaders across the globe must begin planning their approach as soon as possible.

Three considerations for operations leaders when planning for 4G migration:

- The closer it gets to a carrier’s network end-of-life deadline, the more calls about intermittent loss of connectivity support teams will have to field and address, increasing their workload. Field technicians also will be the ones replacing all legacy equipment. MSPs/ISOs thus need the staff resources to expediently replace older POS terminals, ideally before customers begin experiencing issues. If it is necessary to hire more staff, operational leaders will need to carefully balance budget and customer expectations to allocate the appropriate staff resources, labor and time.

- Any POS terminals that are not 4G compatible and will be affected by a network shutdown should be upgraded sooner rather than later. This is far easier to manage proactively than it is to manage reactively; this is especially the case as the global semiconductor shortage is creating longer lead times on new equipment availability. Being proactive also may help an organization avoid some connectivity-related customer complaints.

- Reterminalization doesn’t come without a price. Yet while it may be tempting to try to squeeze every last bit of life out of terminals, that creates a business risk as carriers move resources away from the network being decommissioned and customers with older terminals begin experiencing connectivity issues. Operational leaders will need to balance the significant cost associated with replacing terminals against both the useful life left on the existing terminal estate and the level of operational risk they may incur.

Solutions that Solve the Challenges of 4G Migration

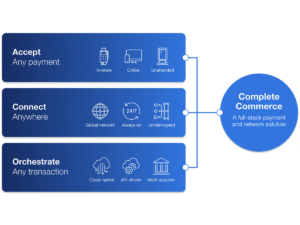

As operations leaders plan for network shutdowns, a critical component of the plan will be identifying the right equipment to replace customers’ legacy terminals. The equipment must be 4G compatible, of course, but it also should help mitigate current and future challenges associated with providing payments solutions to customers — during migrations and normal times alike.

For example, TNSPay Mobile provides a reliable, turnkey option for MSPs and ISOs that can simplify management of a wireless terminal program. This secure, complete wireless POS gateway provides high-speed transaction delivery over TNS’ PCI DSS-certified TNSPay Mobile processing environment.

Using 3G and 4G technologies, TNSPay Mobile supports a wide array of terminals, processor connectivity, industry-specific applications and payment types.

Not only is it 4G compatible, it’s also highly reliable. Communications redundancy and multiple transaction routing options virtually eliminate the risk of service interruption, even during network shutdowns.

It also may help to ease some of the pain of reterminalization costs. TNSPay Mobile requires no up-front capital investment and minimum operating expense, giving a service provider an efficient way to meet merchants’ end-to-end wireless POS needs. It also allows MSPs/ISOs to expand a service portfolio to support merchants that require a wireless solution, and thus increase revenue by providing the wireless access as part of the service instead of a merchant purchasing it separately.

Another option: Global Wireless Access (GWA), a wireless access solution for POS terminals, was specifically designed to help the payments industry simplify the deployment and management of SIMs for mobile POS terminals, including during network migration.

GWA provides comprehensive international coverage with in-country domestic roaming to minimize coverage gaps. Combining industry-leading features such as strongest-signal intelligent roaming SIMs and an advanced SIM management portal, GWA provides high wireless POS uptime through strongest signal connectivity; no “preferred” networks or steering, private APN and a dedicated app to ensure the terminal is always connected to the best network.

What does that mean? This “smart SIM” can attach to multiple carriers. It checks the data throughput (i.e., capacity) available on all accessible data channels and attaches to the optimum channel, regardless of the underlying operator. This improves performance during carrier migration periods because the SIM can use the available resources of multiple carriers, not just those of a single wireless operator. This helps mitigate connectivity-related customer issues.

These two TNS SIM offerings are examples of the POS solutions offered to help MSPs and ISOs provide their customers with the most reliable technology and keep their businesses up and running. Contact us today to learn more about TNS’ Global Wireless Access or TNSPay Mobile.

Dan Lyman is Head of Global Products for TNS’ Payments Market business. He leads a global team of product specialists and is responsible for driving product innovation across TNS’ extensive portfolio of payments solutions.