As we approach the end of a tumultuous year, I think we will all agree that it’s safe to assume that world events are going to continue generating stock market volatility well into 2021. Shrewd strategic decision makers are not only recognizing this, they are planning for it too because while volatility does cause unrest it can be used to the advantage of traders and many have benefited from this for decades.

In the ‘old normal’ it was uncertain economies and creditworthiness that drove the highest volatility levels, causing wide-ranging swings of the Dow Jones Industrial Average on an annual, quarterly and sometimes daily basis. World event contributors to volatility were occurrences like influential elections, acts of terrorism and such, which were typically ringfenced to a particular duration in time.

The coronavirus pandemic has put a completely different and unpredictable spin on volatility. It is likely that this will continue as we see recurrences of high infection rates, as well as key developments in vaccine trials and eventual roll outs.

So, as we’ve become accustomed to the ‘new normal’ at home, traders are doing so as well and those that address volatility as an opportunity are set for big potential rewards.

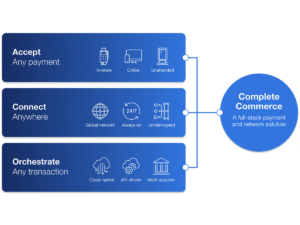

With volatility, the critical issue is speed. Prices can change in a millisecond and traders must act fast to gain advantage. TNS Layer 1 is a solution which has been devised on a unique single hop architecture that is up to 10 times faster than traditional layer 3 architectures. TNS Layer 1 delivers ultra-low latency of between 5-85 nanoseconds, which we believe to be among one of the fastest trading infrastructure speeds in the world today. It provides resilient and efficient access to global market data as well as carries trade orders.

The Chicago Board Options Exchange’s CBOE Volatility Index (ticker symbol VIX), is many traders’ first choice of measure to incorporate volatility expectations into their strategies. TNS, as a provider of market data for the Cboe Global markets options exchanges as well as the CBOE Futures Exchange, can provide streaming VIX or equity options data at any major US financial datacenter via our low latency backbone. Combine this with a trading infrastructure that uses TNS Layer 1 and the trader is in the driver’s seat.

When we emerge from this pandemic many traders will have achieved a personal best, while others may be left battered and bruised on the sidelines. Now is the time to set your strategy for 2021 so that you are in the strongest position to succeed.

If you would like to know more about TNS Layer 1 visit www.tnsi.com or email solutions@tnsi.com.

Jeff Mezger is Director of Product Management at TNS with responsibility for its managed services for the financial industry. He oversees product development and strategy for market data, online and data center services.