Asia’s financial markets continue to create new opportunities. In a world where competition can become aggressive and damaging, Asia provides a rich offering with each country delivering a growing number of opportunities to traders seeking to establish a vibrant portfolio.

This year, despite the ongoing pandemic, several key developments have occurred which efficient and technology savvy traders have turned to their strategic advantage. In this blog I’m going to touch on a couple of these which demonstrate the region’s growing importance to global traders and look at how firms can benefit.

MSCI Rebalances and Expands Indices

When MSCI announced last year that it was moving its derivatives index to Hong Kong Exchanges and Clearing (HKEX) from Singapore Exchange (SGX), few were surprised as the race to access China’s huge base of potential investors was already under starters orders.

This year it has further strengthened its regional targeting. MSCI expanded its flagship MSCI China A Index Series in May with the addition of five STAR Market stocks from the Shanghai Stock Exchange. This marked the first time that technology-focused STAR Market stocks have been included in the Stock Connect only index and overshadowed the announcement that the index had grown by another 15 securities as well, taking it to almost 500 constituents.

Also, in May this year, MSCI announced that it would start tracking Alibaba’s Hong Kong shares instead of its US shares, after it dual listed in 2019 following the multinational’s original 2014 New York listing. Among the indices affected is the benchmark MSCI Emerging Markets Index that many institutional investors leverage for their trading strategies outside of the US, Europe and Japan.

Hong Kong Targets ETFs and Futures

In February, HKEX became the first global financial marketplace to be allowed to invest in a Chinese exchange when it was granted a 7% stake in the Guangzhou Futures Exchange. Known for being one of the world’s fastest-growing clusters of urban centers, the Guangzhou Futures Exchange plans to offer futures contracts for carbon emissions. With China targeting to become a carbon-neutral economy by 2060 this development is likely to create interest among many traders.

We saw another interesting development in June when HKEX welcomed its first EFT cross-listings in Hong Kong and Shanghai under the new Hong Kong-Mainland Scheme announced in 2020. New HKEX CEO Nicolas Aguzin heralded the development as an important step in the deepening of collaboration between Hong Kong and Mainland exchanges. Hong Kong’s ETF market has one of the most diverse product offerings in Asia and currently has over 140 Hong Kong-listed ETFs with more than HK$400 billion of assets under management.

Singapore to Launch Climate Impact X

SGX shook off its disappointment at the MSCI move by announcing it is joining forces with DBS Bank, Standard Chartered and Temasek, to develop a global exchange marketplace for high-quality carbon credits. Climate Impact X (CIX) has been conceived to address the estimated global demand for two gigatons of carbon dioxide annually by 2030.

Robust demand to manage risk across multiple asset classes has kept SGX buoyant with the group reporting in May that derivatives traded volume was up 5% year-on-year. Its MSCI Singapore Index Futures were up 17% to one million and total FX traded volume had also risen year-on-year by 30%.

Japan Prepares for New Market Segments

There are now less than nine months until the Tokyo Stock Exchange Inc will be restructured into three new market segments – Prime Market, Standard Market and Growth Market. It hopes this move will boost listed companies’ sustainable growth as well as strengthen mid to long-term corporate value creation.

Japan’s financial markets have been bolstered this year by closer links with the Shanghai Stock Exchange and Shenzhen Stock Exchange after it simultaneously listed new ETFs under the Japan-China ETF Connectivity Scheme. The agreements with the Chinese exchanges set up in 2019 and 2021 respectively allow investors in Japan to indirectly invest in Chinese assets through feeder ETFs of China-listed ETFs listed on the Tokyo Stock Exchange, while Chinese investors can benefit from indirectly investing in Japan.

Technology is Key to Navigating Asian Success

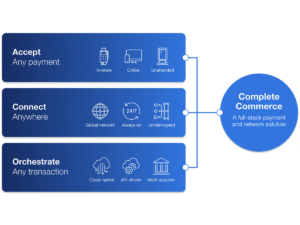

The key to a successful Asian trading strategy is to react to opportunities quickly and efficiently by having the tools necessary already within your arsenal. Traders leveraging the Asian financial markets need effective means of connecting to multiple markets with each one adding complexity to a diverse trading infrastructure. Outsourcing is the perfect format to address one-to-many connectivity and reap the benefits of an Infrastructure-as-a-Service (IaaS) approach.

A global connectivity partner, such as TNS, which already has established links throughout the region and local teams on the ground can provide vital speed to market. With TNS, we typically deliver on-net connections within just 48 hours so you can be trading as soon as possible. We also offer flexibility to test markets so traders can better evaluate market potential with a live test, without any capital outlay.

Connectivity can be enhanced further by taking advantage of a Managed Hosting solution which gives traders a presence within the colocation sites of the key exchanges. We can offer extensive coverage across 11 countries and 22 exchanges in Asia, including Managed Hosting options at HKEX, Japan Exchange Group (JPX) and SGX.

As Asia continues to develop and emerge as a powerhouse of global opportunities, we expect to see growing levels of activity as traders pivot their strategies accordingly. To find out how TNS can help you target the Asian financial markets email solutions@tnsi.com.

Jeff Mezger is Senior Director of Product Management at TNS with responsibility for its managed services for the financial industry. He oversees product development and strategy for market data, online and data center services.