- Prev

- 1

- of

- 26

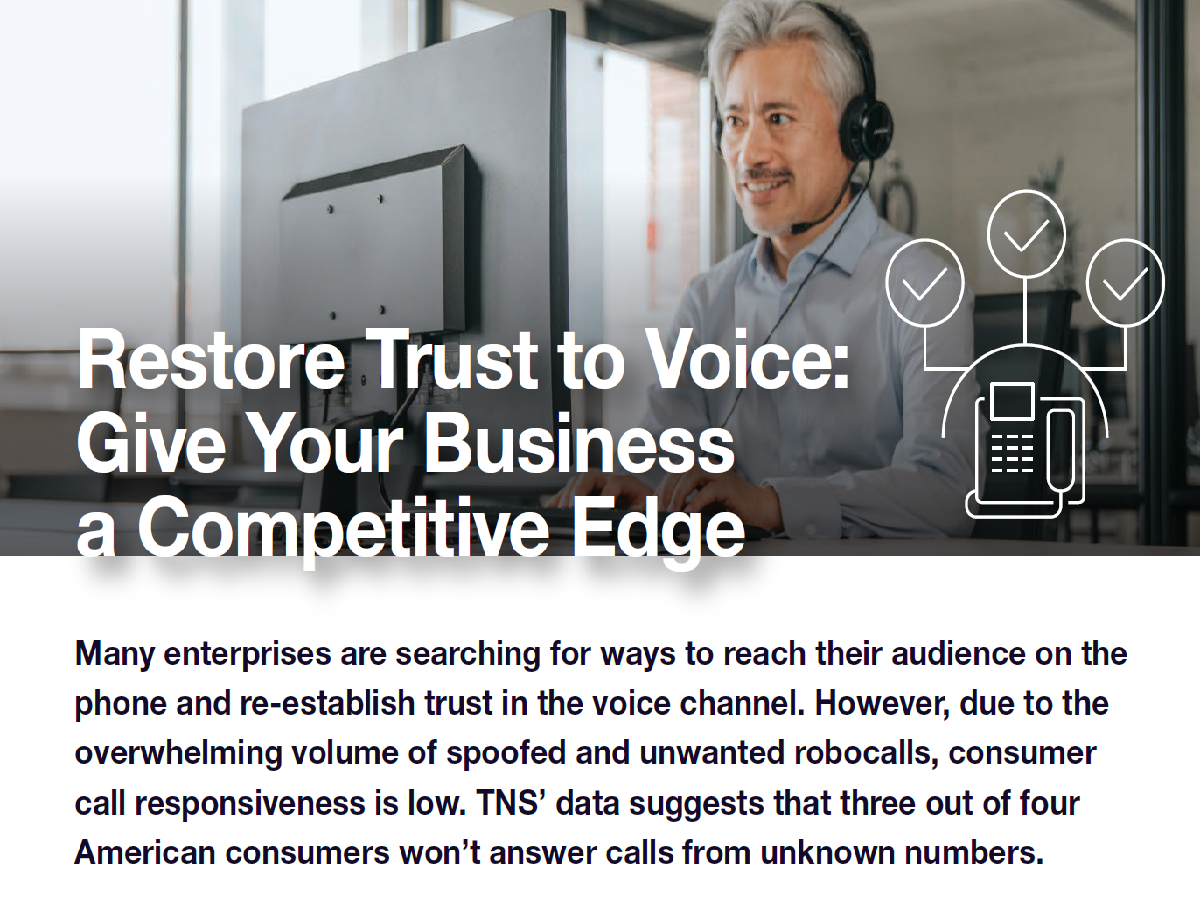

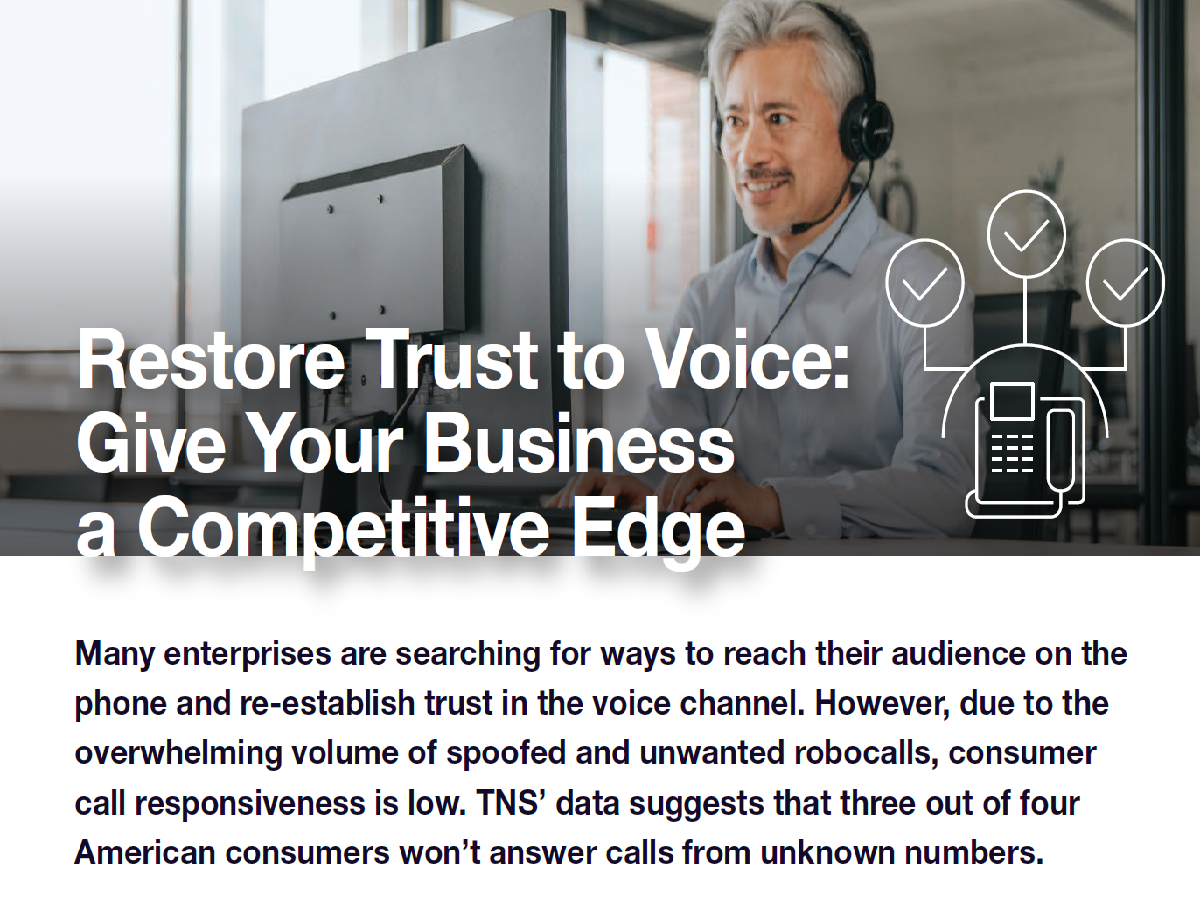

Learn More about TNS Communications Solutions

Explore how TNS’ Communications Solutions restore trust to voice and protect subscribers, whether for carriers or for enterprises.

TNS Communications Resource Center

TNS’ unified call identification platform restores trust to voice and drives the future of next generation communications. TNS analyzes more than one billion calls a day, synthesizing data into widely trusted and utilized robocall protection reports, white papers and other thought leadership. Learn more about TNS’ IaaS solutions.

Explore how TNS’ Communications Solutions restore trust to voice and protect subscribers, whether for carriers or for enterprises.